Will the US Continue to Stifle Its Crypto Market?

14 August 2024

Last week's Weekly focused on the crash that occurred in the preceding days. Market-wide panic ushered in a turbulent trading week, sparking a wave of varied emotions among investors. In the second half of the week, the market rebounded, and calm returned. But how do things stand now? You’ll find out in this Weekly!

This weekly in brief:

- Market: After the sharp decline in the crypto market early last week, a recovery followed on Thursday. Bitcoin's price is now around $61,000, and ether is around $2,700.

- News: The hoped-for political shift by the Democrats regarding the US crypto sector has yet to materialize. Reportedly, Kamala Harris is following in the footsteps of her current boss, President Biden.

- Behind the Scenes: We see increasing interest in investing in crypto assets, despite last week's sharp price declines.

Market Update

After last Monday’s rapid price drops (A), a sudden recovery followed a few days later (B). On Thursday, bitcoin’s price jumped 12% from $55,000 to $62,000. This brings us back to the middle of the structure we’ve been in for five months.

The decline briefly took us to $49,000. That’s exactly the highest price bitcoin hit on January 11, the day the US ETFs were launched (C), and for other reasons, an important horizontal price level. It’s no surprise that the market found support here.

The price also briefly cut through the 50-week average at $50,100, a slow-moving average that has often been the first dividing line between bull and bear markets in the past. A weekly close below this would be a strong signal of weakness. Fortunately, we remained far from that, with a weekly close of $58,700.

It was a few tense days, but the strong recovery has kept the market steady. Bitcoin’s price has touched the upper trendline, now at $69,900, five times. On the downside, we’ve now reached the fourth touchpoint. Are we on our way up again?

To confirm this, we must first break through an important zone around $62,000. Coincidentally, both the 50-day and 200-day averages are located here. The chart below nicely shows how they are currently providing resistance.

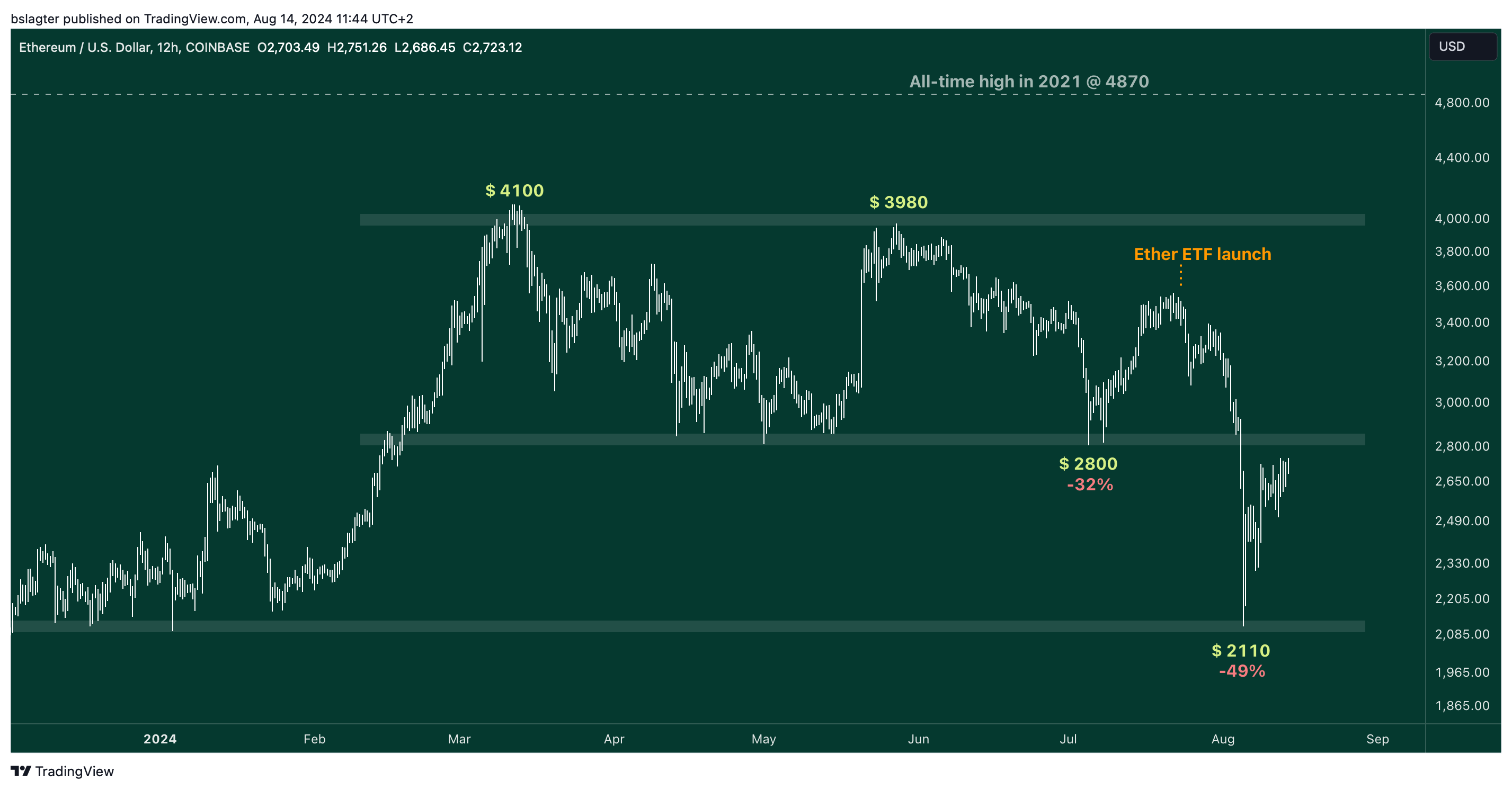

It has now been three weeks since the ether ETFs began trading. As expected, the initial period was marked by outflows from Grayscale’s ETHE fund, where investors had been trapped for years. A total of $2.3 billion worth of ETHE was sold.

The other Ethereum funds have seen an inflow of $1.9 billion in their first fourteen trading days. And that’s impressive. The outflows at ETHE are drying up, while the inflows at the rest have the potential to remain strong for years.

Ether’s price has yet to benefit from this. Last week’s financial market turbulence did not spare ether. The price dropped to just above $2,100, a level where we also saw support earlier this year. The lowest point was 49% below the peak. There’s still a lot to recover. The first step is to reclaim the zone around $2,800.

News Overview

Since last year, crypto companies in the United States have feared for survival. Not because authorities are choking them one by one, but because they are being sidelined by an invisible hand.

To understand what’s happening, we need to briefly go back to 2013. That’s when the Americans launched ‘Operation Choke Point’, a project aimed at combating fraud by pressuring banks to sever ties with high-risk industries. Think payday lenders, online casinos, and gun dealers. The idea was simple: cut off the money flow to these sectors so that they wither away naturally. A sneaky approach that worked.

Now, let’s jump to 2023. In the years leading up to it, the crypto market had shown both enormous gains and losses, attracting the attention of regulators worldwide. They were concerned not only about volatility and the risks to investors and the traditional financial system but also about the potential for money laundering, tax evasion, and other illegal activities. For some in Washington, the crypto world still seemed like the Wild West, justifying the urgent need for stricter regulation.

This led to what some call Operation Choke Point 2.0. Although the government doesn’t officially use this term, critics see it as a subtle and gradual approach to curtail the crypto sector. Banks and financial institutions are once again being encouraged to limit or completely stop their services, but this time, the target is the crypto sector.

These concerns faded into the background as attention shifted to the upcoming presidential elections, which became the central topic of discussion. Presidential candidate Trump positioned himself as the protector of the American crypto landscape and led the polls. For many leaders in the industry, it seemed a strategic move at the time to openly align with the Republicans.

However, political dynamics can change quickly. Biden was succeeded by Kamala Harris, who initially was not expected to stand a chance against a seasoned politician like Trump. Yet Harris is performing excellently in the polls. In her short time as a candidate, she has emerged as the favorite. And her stance on the crypto market? That has suddenly become important to those who previously swore loyalty to Trump.

The first signals about her intended policies are starting to emerge, and they paint a grim picture. According to Nic Carter, the man who brought attention to Operation Choke Point 2.0, Harris is shaping up to be Warren 2.0. This refers to one of the driving forces behind the stranglehold with which the Biden administration is suffocating the crypto sector: Senator Elizabeth Warren.

Not all Democrats support Biden and Warren’s crypto policies. Some party members have launched the ‘Crypto for Harris’ campaign to express their concerns. Additionally, part of the industry is actively reaching out to Harris’s campaign team to clarify their positions. Will Harris be willing to deviate from the current party line? That seems unlikely at this point!

💡 Crypto savings plan

Spread your purchases over a longer period and invest in crypto without actively engaging yourself in it. This investment strategy is known as Dollar Cost Averaging (DCA). With it, you invest at an average purchase price, reduce risk, and gradually build up your position.

Want to buy crypto assets periodically and automatically? With the crypto savings plan, it's easy to do. All you have to do is make sure there is sufficient balance in your account.

Other news:

- The number of bitcoins parked on exchanges has dropped to a low point, according to data from analytics firm CryptoQuant. Analysts value this metric because they link it to the likelihood that a large number of players are on the verge of liquidating their holdings. A decline in exchange reserves suggests that traders are setting aside their funds in self-custody for the long term.

- Ripple scores another victory in the lawsuit over token issuance. Instead of the demanded $2 billion, it only has to pay a fine of $125 million, and the judge ruled that the XRP token should not be classified as a security by default. This seems to be a favorable end to a years-long process for the company. Although the price of the XRP token bounced slightly after the ruling, it has suffered significantly over the years due to the legal battle.

- FTX must pay a total of $12.7 billion to creditors. That is the outcome of a lawsuit brought by the CFTC against FTX, Alameda Research, and several involved executives. According to FTX, creditors will receive at least 100% of their (dollar-denominated) claims back. However, not everyone is happy with this: the price of bitcoin was well below $20,000 in November 2022.

Behind the scenes

We are seeing increasing interest in investing in crypto assets. Last week's sharp price drops caused panic in the market, but not among Amdax customers. On the contrary, the number of (new) investments in crypto assets through our platform showed a strong increase in the past week compared to the previous weeks.

This highlights the serious crypto investor's long-term belief in the crypto market. And we at Amdax fully support that.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.