Trading in Ethereum ETFs begins

24 July 2024

In the past two eventful weeks, the bitcoin price has risen by more than 25%. Fear and concern have given way to cautious optimism. The Ethereum ETFs have been launched, a high-profile bitcoin conference begins on Thursday, and the bulls see that the path to a new all-time high is relatively short with a 12% increase. But is that a plausible scenario? Find out more in this Weekly!

- Market: In recent weeks, fear and concern colored the mood in the crypto market. This week, we saw through various indicators that the market is slowly showing more strength again.

- News: Trading in the new spot ether ETFs started on Tuesday. Investors massively withdrew funds from Grayscale's expensive fund (ETHE). BlackRock (ETHA) and Bitwise (ETHW) compensated for that outflow with an inflow of more than $460 million.

Market Update

Two weeks ago, fear and concern colored the mood in the crypto market. The German government sold 50,000 bitcoins, miners were forced to sell some of their bitcoin reserves, and the MtGox trustee had yet to start distributing tens of thousands of bitcoins.

Investors held their breath and their wallets closed until one by one, the worries dissipated, and the price found its way up. In two weeks, the price rose by 28% from $53,500 on July 5 to $68,000 on July 21.

The weekly chart of bitcoin clearly shows how strongly the price has recovered. We are back in the price range between $60,000 and $74,000, the zone where the two peaks of the 2021 bull market fell. Prices that were only possible with hype and euphoria at that time are now seen in a cooled-down market. If a similar enthusiasm emerges now, much higher prices are likely.

If the bottom of July 5 is indeed the lowest point of this correction, then it is again a higher bottom than the bottom at the end of January at $38,500. A series of higher lows (HL) and higher highs (HH) on the weekly chart is characteristic of a bull market.

The price has come much closer to the 50-week average during this correction but has remained well above it. This could be translated as follows: bitcoin now feels much less expensive than at the peak in March, but the bull market is not over yet.

The shift from a weak to a strong market is also reflected in other data. We see rising trading volumes, an increase in the number of crypto app downloads, and growing capital inflows into U.S. bitcoin ETFs. Additionally, social media sentiment has shifted from fearful and worried to cautiously optimistic.

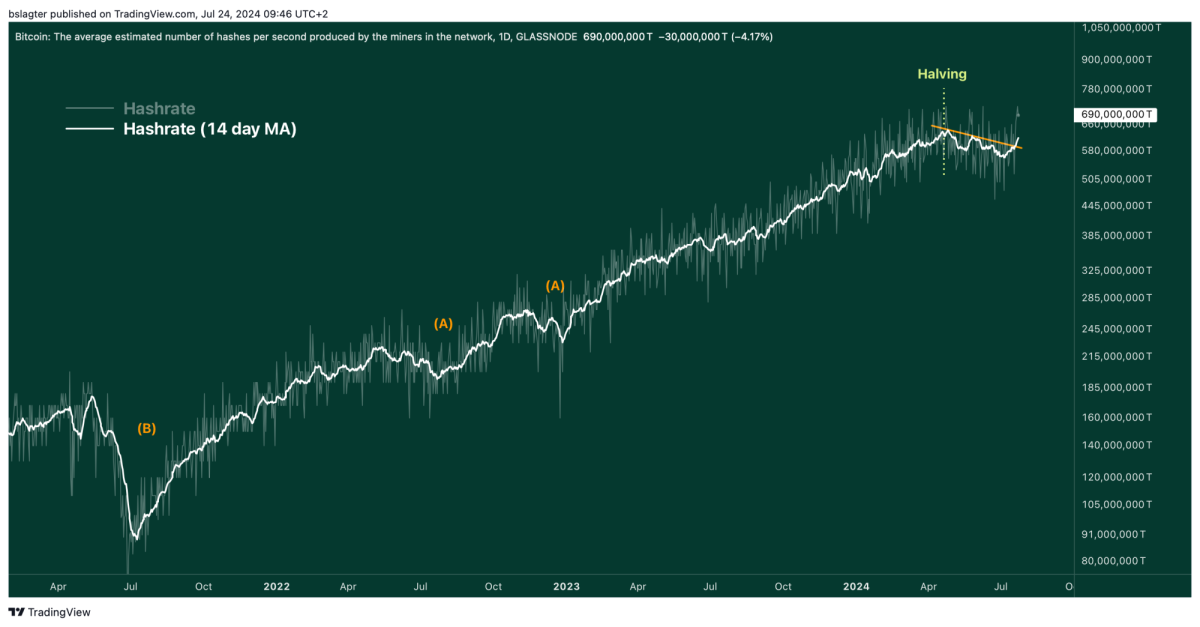

Below is the chart of the bitcoin network's hashrate. This is a measure of the total computational power that miners use to add new blocks to the blockchain. A declining hashrate can indicate that miners are under pressure and may need to sell bitcoin.

After the halving, the hashrate began to decline. Miners saw their revenues roughly halved and adjusted their operations accordingly. We now see the first signs of the end of this decline. This dip in the hashrate would thus be roughly as large as the one in 2022 (A) and significantly smaller than the one in 2021 (B).

This week is all about the launch of the Ethereum ETFs. Later in this Weekly, we discuss how the first trading day went. The price of ether has remained quite stable in recent days, despite somewhat higher trading volumes leading up to the launch.

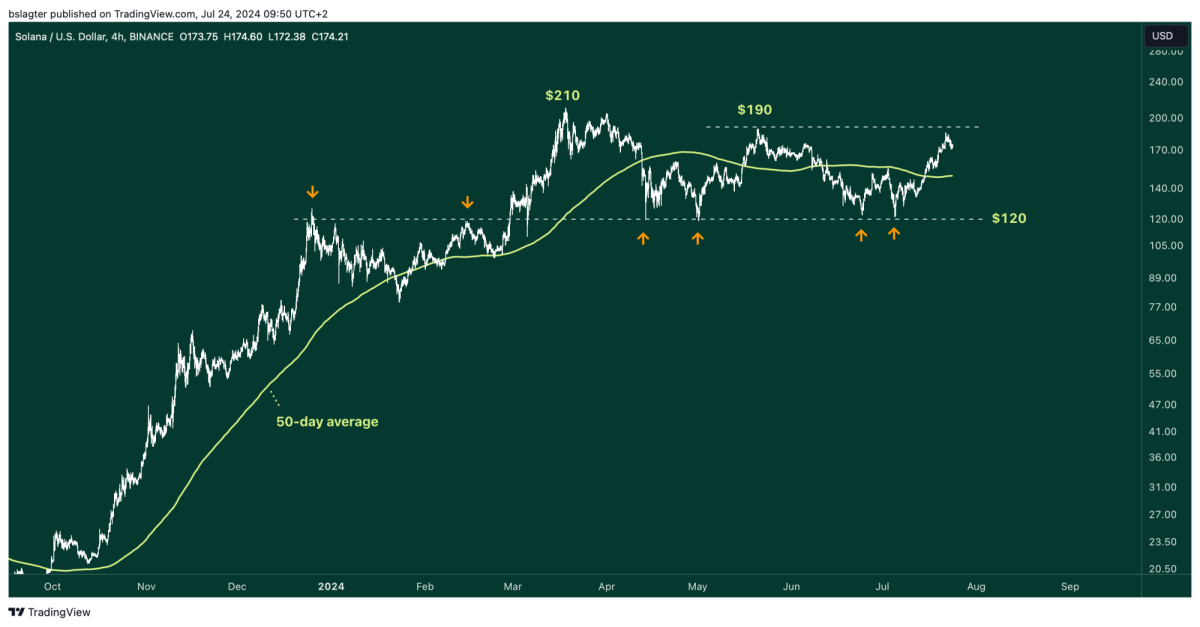

Because we can't yet accurately assess the impact of the ETFs on the price of ETH, this week we are looking at SOL. The coin of the Solana network experienced an impressive rise from $17 to $210 between September and March. That the price only dropped 43% to $120 during the correction that followed is equally impressive. Bitcoin fell 27% and ether 31% in the same period.

The recovery after the bottom on July 5 also looks strong. The price of SOL is well above the 50-day average and comfortably in the upper half of the price range of this correction. If the price breaks above $190, then $210 is the next target, followed by the all-time high from 2021 at $267.

News Overview

Last Monday, Bloomberg analyst Eric Balchunas announced a preliminary schedule for the proposed spot ether ETFs. It consisted of three steps: fund managers had to submit their final applications on Wednesday, approval was to follow on the next Monday—two days ago—and finally, trading would begin on Tuesday, July 23.

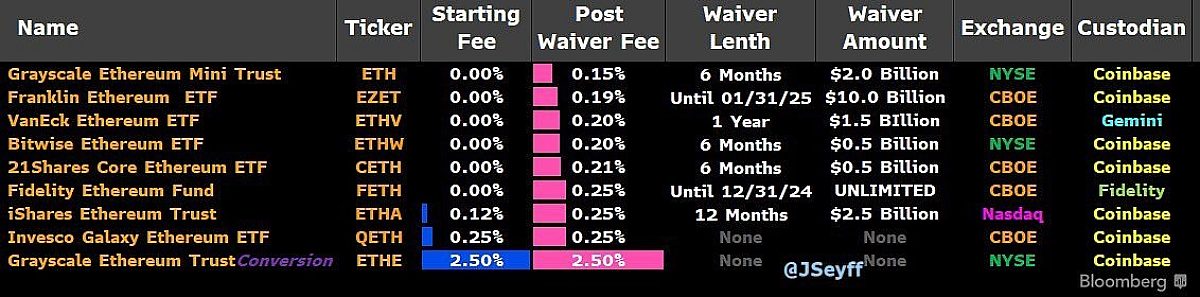

All steps are now behind us, and Balchunas’s prediction has proven to be accurate. A total of nine funds are participating in a race to attract the most investor dollars. To appeal to investors, the funds have low fees, ranging from 0.15% to 0.25% per year, except for Grayscale (ETHE), which, at 2.5%, is ten times more expensive than the others.

It is therefore likely that we will see another significant outflow of capital from ETHE. We saw this same dynamic when Grayscale converted its bitcoin fund (GBTC) into an ETF. The first trading day of the ether funds seems to confirm this: nearly $500 million flowed out of the fund. Of the $9.1 billion in ether that was held as of Tuesday morning, only $8.6 billion remained by Tuesday evening.

A portion of this will find its way into cheaper ether funds, but not all of it. The new, cheaper fund from Grayscale, which was expected to absorb the outflow, collected only $15.2 million in ether on its first trading day. The BlackRock fund (ETHA) performed the best, with an inflow of $266.6 million.

In the medium term, most analysts are optimistic about the performance of the Ethereum ETFs. Bitwise CIO Matt Hougan’s prediction? “The inflows will push the price of ether above $5,000,” setting a new record price.

Hougan supports his viewpoint with three arguments:

-

Ether inflation is low. “Exactly 0% per year,” writes Hougan. “A large amount of new demand and 0% new supply? I like that math.”

-

ETH stakers don’t need to sell. “For bitcoin, it’s generally true that miners need to sell some of their earnings,” notes Hougan. “Parties staking ether don’t have these high costs and can keep the ether they produce.”

-

A large portion of the ether supply is locked. “Nearly 40% of all ether is not available for sale,” writes Hougan. He claims that 28% is locked in staking and another 13% is used in smart contracts, for example, as collateral for a loan.

It’s relatively easy to present alternative arguments alongside Hougan’s. For example, ether’s inflation rate is currently higher than bitcoin’s. And while ETH stakers don’t have to sell, they can. The same applies to the portion of the ether supply claimed to be ‘locked’ and inactive.

However, it’s not an outlandish scenario that activity on the Ethereum network increases and the dynamics of hodlers remain largely unchanged. In that case, significant inflows could drive the ether price up substantially. “I’m counting on success,” writes Hougan. “I expect the funds to collectively raise more than $15 billion in the first eighteen months.”

Ethereum Staking at Amdax

The ether funds in America have excluded the option for investors to stake their ether. As a result, they cannot generate additional returns on their ether holdings. At Amdax, this is possible, and we make staking available to everyone without a minimum deposit required.

Do you own ether and want to generate extra returns? This can be done easily via the Amdax app or web platform.

Other news:

- 80% of central banks expect to lower interest rates this year. This is the highest level since 2021. In comparison, only 10% of central banks had a similar expectation in July 2023. So far this year, 42% of central bankers have already implemented a rate cut. The Canadian and European central banks were the latest to do so. The global focus now shifts to the U.S. Federal Reserve, with market expectations pointing to a potential rate cut in September.

- Craig Wright is not Satoshi Nakamoto. While you likely already knew this, fraudster Wright himself has now admitted that he is not the person who invented and built bitcoin. Not because he wants to, but because a British judge has ordered him to do so. In the coming months, this message will be prominently featured on all his (social) media channels. The bitcoin whitepaper is now available again in the UK, and parties who have suffered due to Wright are rightfully celebrating.

- Bitcoin investors are turning their attention to the United States this week. Not only because U.S. investors currently dominate the crypto market, as evidenced by the return of the Coinbase premium, crypto apps rising in the rankings, and significant inflows into U.S. bitcoin funds. But also because a major bitcoin conference is scheduled this week. The event has secured presidential candidates Trump and Kennedy Jr., and is also reportedly in talks with the newly announced candidate Harris. The program starts on Thursday.

Deepen

In the podcast What Bitcoin Did, host Peter McCormack speaks with Christian Keroles, who holds a director position at the Human Rights Foundation. From his role, Keroles sees daily how crucial it is for people to have control over their finances. He observes that bitcoin is a significant driver in this regard and explains how he believes bitcoin will change the world!

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.