The bitcoin IPO

3 January 2024

We have had a meaningful week. The chaotic process by which spot bitcoin ETFs were reviewed ended with approval. Meanwhile, we have completed the first three days of trading. The bitcoin IPO is a fact! More on this in this Weekly.

This Weekly in brief:

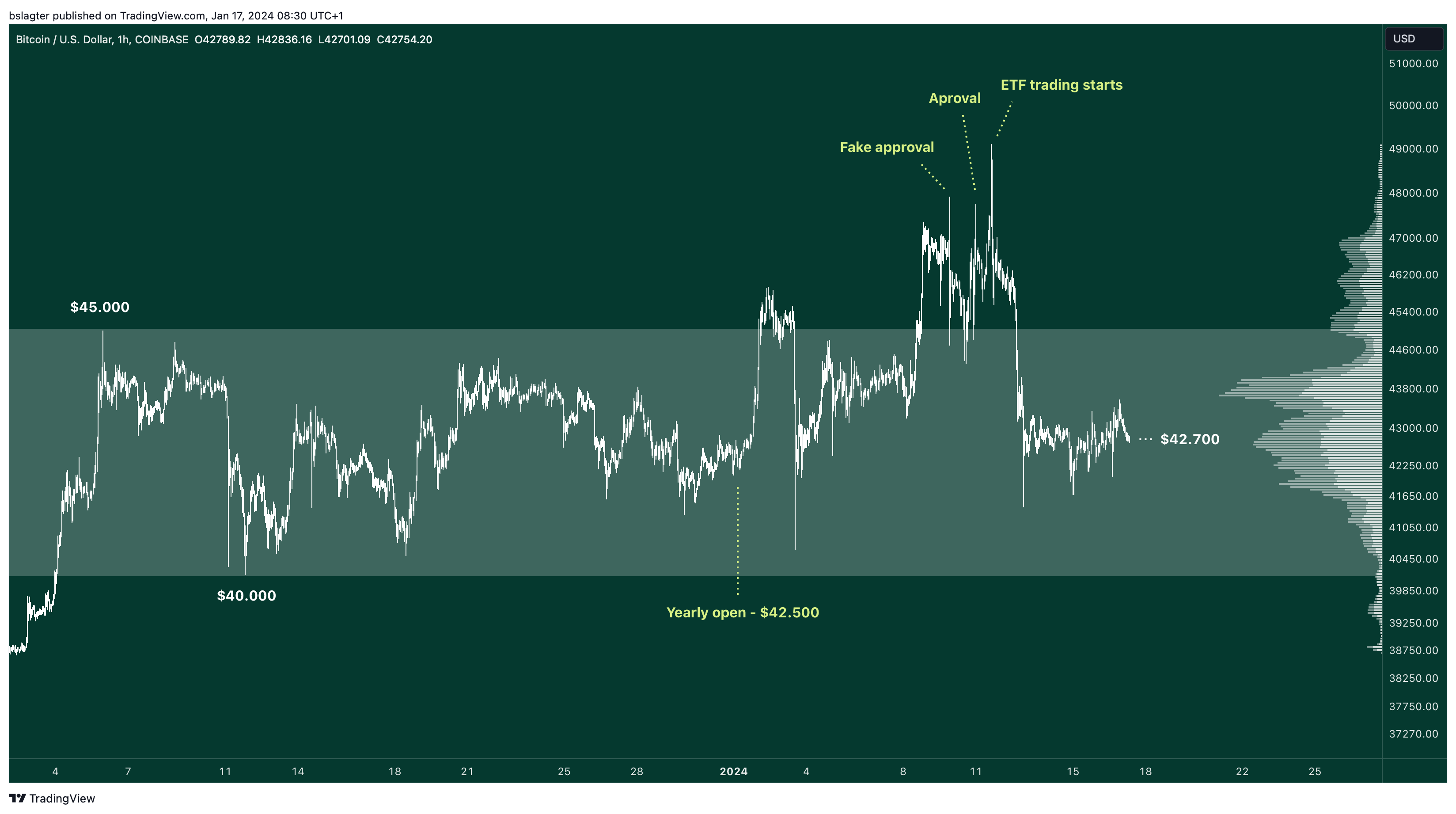

- Market: Immediately after the launch of bitcoin ETFs, the price of bitcoin soared to $49,000, its highest point in two years. The price then dropped back a bit but is still around the year-opening high of $42,500. Ether surprised with a big price jump to $2700.

- News: The ETF race has started. By all standards, analysts are calling it a huge success. Analysts attribute the post-launch price drop partly to the release of bitcoins from the previously closed Grayscale fund.

- Behind the scenes: Friday, January 19, from 10:00 to 11:00, in a (Dutch spoken) webinar together with BDO we look ahead to the upcoming crypto year: what are the expectations for the crypto market and tax legislation? You can register here!

Market update

Last Wednesday, the US regulator SEC approved the bitcoin ETF of BlackRock and 10 other applicants. Trading started the following day. The price of bitcoin soared to $49,000, its highest point since December 2021.

Just a day earlier, the market was thrown into turmoil by a fake message on the SEC's X account announcing approval. The SEC turned out to be hacked. Actual approval followed on Wednesday evening, accompanied by an extensive report from the SEC with substantiation, an explanation from chairman Gary Gensler, and a stream of documents allowing for the start of trading on Thursday.

The US ETFs also made it into the national dailies and news in the Netherlands. Understandably so, as this launch was a special story. Applications have been made for more than a decade, which the SEC rejected each time. Until the court ruled last summer that these rejections were unjustified.

You can think of the arrival of ETFs as bitcoin's IPO. They make bitcoin accessible and legitimize bitcoin as an investment. Including bitcoin in an investment portfolio has shifted overnight from radical to acceptable, or even sensible.

Trading started on Thursday. The first two days were a great success. Still, the share price fell. That was in line with expectations. Last week, we discussed that the approval itself was already factored into the price and that a further rise in the price must come from the new group of investors tapped by the ETFs.

It is likely to be months before that capital flow really kicks in. The ETFs must first be made available in all systems. After that, financial advisers can talk to their clients about them. A final investment decision will follow that.

Analysts at Bloomberg spoke in October of $150 billion in new investments over three years. Last week, British bank Standard Chartered predicted it will be as high as $100 billion by 2024. Either way, this will be a strong tailwind for the crypto market in the rest of 2024. That the share price is now showing some weakness at first does not alter this.

That weakness is quite explainable. Investors in Grayscales GBTC can exit without a discount for the first time in two years. And speculators who gambled on the ETFs' approval can now take profits. That could cause further price correction in the coming weeks. Nevertheless, the long-term outlook remains positive.

The SEC gave bitcoin an exemption position upon approval, saying "[today's approval] is cabined to ETPs holding one non-security commodity, bitcoin". Chairman Gensler made the comparison with ETFs holding precious metals. The SEC has argued in several court cases that it views many other crypto assets as securitized.

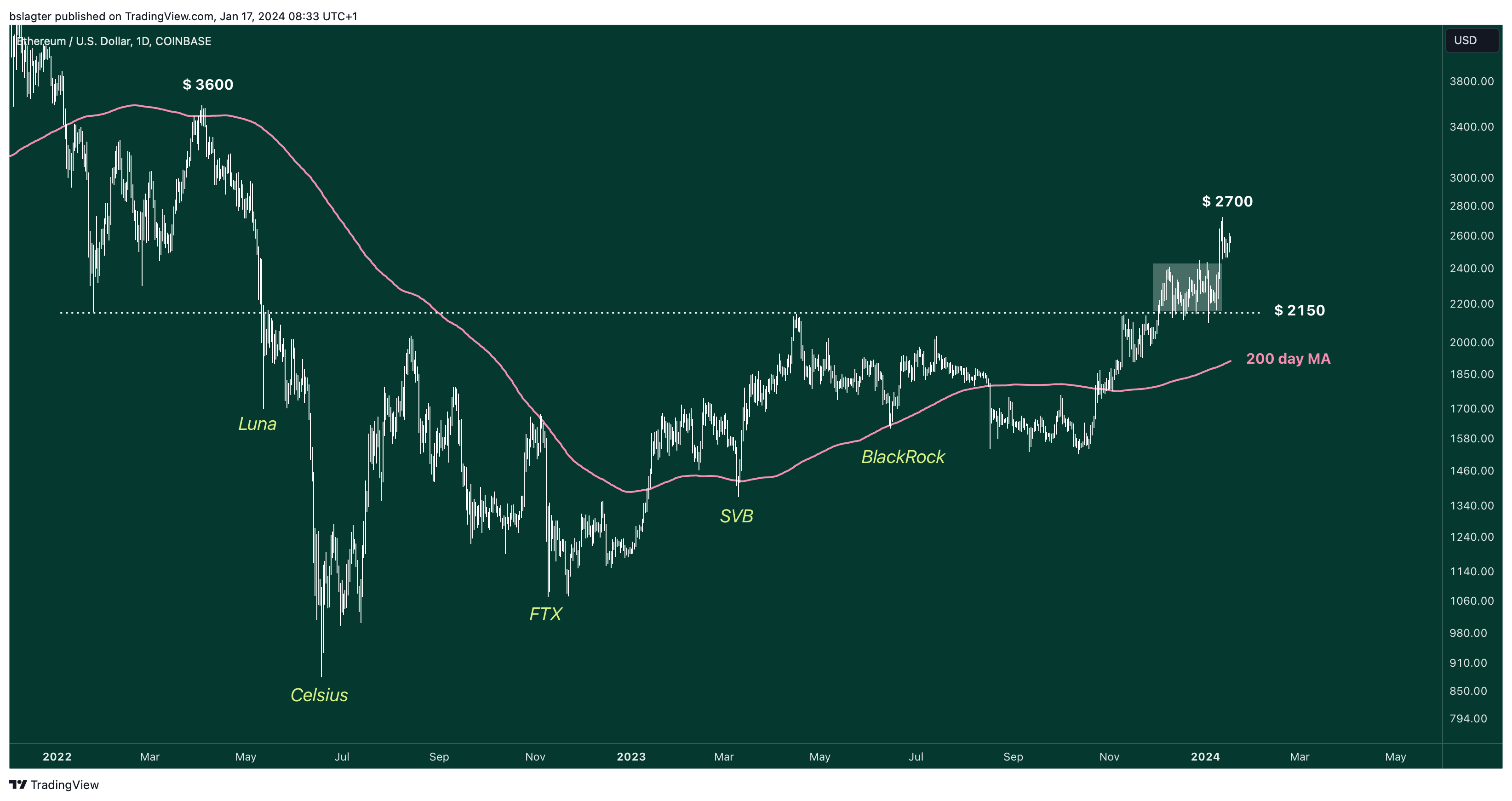

One notable exception is ether, which, like bitcoin, is repeatedly not mentioned as a security. Possibly that gives room to allow a spot ether ETF in addition to bitcoin. Applications for that have already been filed late last year, including one from BlackRock. There are more favorable signs. For instance, ether futures are traded on the regulated derivatives exchange CME, and there have been ether future ETFs since last year.

Bloomberg experts informally talk about a 50% to 70% chance that the SEC will approve the seven applications for a spot ether ETF in May this year. That explains why the price of ether rebounded immediately after the bitcoin ETFs were approved. This is a tailwind for the biggest crypto currency after bitcoin.

The chart of ether's price in dollars looks excellent. In early December, ether broke above $2150, the dividing line between the 2021 bull market and the 2022 bear market. After more than a month of consolidation, the price has now left and touched $2700 on Friday. The price of ether expressed in bitcoin still faces some resistance. Once that is off the table, things could move quickly.

News summary

Clearly, the ETF race we wrote about last week has begun. Among other things, analysts are paying attention to capital inflows. That says something about the competition between fund managers, as well as the demand for new investment products. After the first two days of trading, funds could count on inflows of nearly $1.5 billion. Net of that, taking into account investors leaving the converted Grayscale fund, more than $800 million remained.

For most investors, they have never experienced the launch of a new ETF up close. That's different for ETF analysts like Eric Balchunas, James Seyffart en Nate Geraci. They have made tracking the ETF market their life's work. Because of this, they are well-positioned to assess the launch of bitcoin funds. That they are relatively distant from the bitcoin market makes their judgment all the more reliable.

Eric: "It was an awfully big success. By all standards: volume, number of transactions, cash flows, media coverage. Historic."

Nate: "There is no other way to judge this than a successful debut."

James: "tHiS WaS a fLoP"

James' response is obviously meant to be sarcastic. He is responding to the sentiment among the portion of the bitcoin public that feels the launch has ended in a fiasco. Their judgment is largely based on the price of bitcoin: it did not go up as they hoped, but down.

James offers the following two explanations for this:

- There are traders who bought bitcoin ahead of the approval to speculate on it. They are disposing of their position again.

- Now that the Grayscale fund (GBTC) has been converted to an ETF, people who were previously stuck in the fund can move or sell their positions.

Eric reacts with less patience to people whining about bitcoin price. "No kidding, this was a great launch anyway. Oh, and bitcoin is already up 80% before the approval. I honestly feel sorry for some people who are angry and disappointed about it. I'm not sure you'll ever be satisfied."

According to James, it's a matter of skewed expectations. "Everyone who says it was a flop is producing clickbait or had 'god candle' expectations that lack any sense of reality."

In the week of the launch, an awful lot was written and talked about bitcoin. Out of all the resulting noise, we caught five signals. The most important ones you read above.

Grow your bitcoin wealth

Bitcoin Algo is a so-called algorithmic strategy developed by the econometricians at Amdax to grow your bitcoin wealth. This strategy does that by buying bitcoin at the right times, and reducing losses by selling at the right times.

Amdax only charges performance fees when the amount of bitcoin you own has grown.

Want to put Bitcoin Algo to work for you, too? Read more about it here. You can get started from as little as a 25,000 euro deposit.

Other news:

- The CEO of investment bank Cantor Fitzgerald jumps into the breach for Tether. Speaking to Bloomberg at the World Economic Forum in Davos, Howard Lutnick said that his company has audited Tether's balance sheet. According to Lutnick, Tether actually owns the assets it claims to have in its vault: "We've seen it and they have it." Lutnick also spoke about bitcoin and sees the next boost to its price in the coming halving.

- CoinShares estimates production costs bitcoin at $37,856 after the halving. In early May, the subsidy miners receive for making a block shrinks by 50% at once. CoinShares researchers expect that with the current bitcoin price, only a handful of miners will be profitable. The analysts think the companies Riot, TeraWulf, and Cleanspark are best positioned.

- Ten companies want to launch spot ETFs in Hong Kong. Seven of them have already reached the stage that revolves around "practical implementation," HashKey coo Livio Weng said Weng in a conversation with the Chinese business newspaper Caixin. Weng does not expect the funds to hit the market soon. The application process takes up to six months and the legal framework is not yet complete. Hong Kong lawmaker Johnny Ng wants to change that soon: "This is an opportunity to strengthen Hong Kong's position as a digital asset hub."

Deepen

Major milestone for bitcoin: First spot bitcoin ETF approved in the US

The long-awaited approval of spot bitcoin ETFs marks an important milestone in the recognition and adoption of crypto assets. But, what is a spot bitcoin ETF and why is this big news? Crypto specialist Remo Zuiderwijk explains

Deepen

BNR Cryptocast

Now that ETFs are in the news, a good time presents itself to delve into them. How do such funds work? Can we expect the low-cost products available in the U.S. in Europe as well? What significance does the participation of large, traditional fund managers have? In BNR's Cryptocast (Dutch spoken), Martijn Rozemuller was a guest to explain. As the CEO of the European branch of VanEck, he can give a look behind the scenes like no other.

Behind the scenes

On Friday, January 19, from 10:00 to 11:00 a.m., we are co-hosting with BDO Private Client Services the webinar "A look ahead to 2024: what are the expectations for the crypto market and tax legislation?

In this (Dutch spoken) webinar, Marcel Burger (CIO Amdax) and Marcel Koeslag (Partner at BDO Private Client Services) discuss developments in the crypto market, including upcoming regulations and regulation. We also look ahead to what you as an investor may face in terms of tax legislation surrounding crypto wealth.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.