Soft Landing, An Anxious Market

4 September 2024

As summer comes to an end, Jerome Powell moves the financial world with a single speech. His message? Interest rates will decrease based on favourable data. This "soft landing" scenario sounds promising for investors, especially for riskier markets like crypto. But is this pivot a blessing for the crypto market? More on that in this Weekly!

This weekly in brief:

- Market: August closed with a bitcoin price just above $59,000, marking the seventh consecutive month above this level. In the entire 2021 bull market, this only happened once.

- News: The Trump family is making headlines with the launch of a new DeFi platform. But is this a wise idea? It seems like yet another way to monetize their popularity and fame.

- Behind the Scenes: At Amdax, we continue to innovate to better serve our clients with new solutions. We proudly introduce Novelist, our new wealth management service for the next generation of investors.

Market Update

Every year at the end of summer, central bankers from around the world gather in Jackson Hole, a small town in Wyoming, USA. They talk behind closed doors but also use the conference as an opportunity to address the world through the international press.

Powell’s sermon, like any good sermon, can be summed up in three points:

- We are satisfied with inflation figures and expect them to continue falling toward our goal.

- The labour market is no longer overheated, and it is not desirable for it to cool further.

- Therefore, the time has come to adjust the policy. Interest rates will be lowered, with the speed and timing depending on incoming data.

"The Powell pivot is complete," said WSJ reporter Nick Timiraos. According to him, the speech marks the shift from keeping rates high for a long time to a period of rate cuts.

"Powell delivered the official pivot at Jackson Hole this morning. His message was clear: Mission Accomplished," wrote Alex Krüger. He refers to the mission of fighting inflation without driving the economy into a recession—a soft landing.

This is relevant because not all types of rate cuts are beneficial for risky assets. Often, the start of a new series of rate cuts is forced by severe economic weakening or financial system stability issues, which is certainly not good news for risky investments.

Powell is clear: that is not the case here. From his perspective, we are witnessing a soft landing, with a benign rate cut to accompany it. This is a rare type of rate cut that is favourable for financial markets.

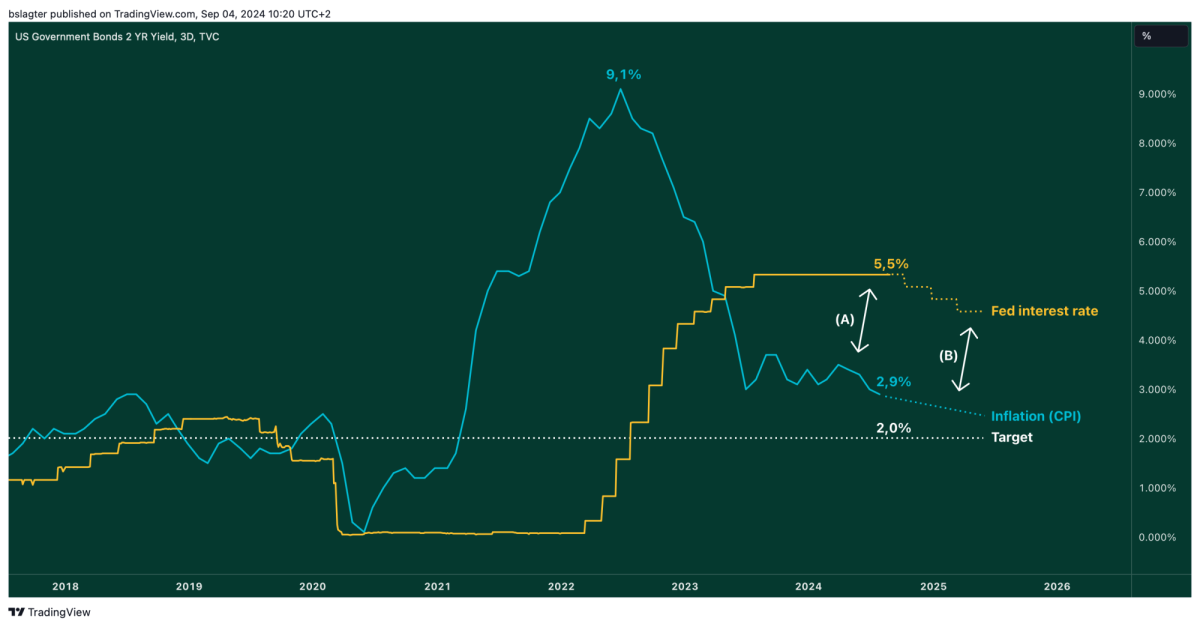

The chart below shows how this works. Interest rates fall along with inflation so that the economy is not unnecessarily slowed down. If the market continues to believe in a soft landing, then looser monetary policy in the coming months will be a tailwind for all risky assets, including the crypto market.

Powell's pivot has not yet led to the end of the correction in the crypto market. For the past seven months, all closing prices have been between $59,000 and $72,000. In the entire 2021 bull market, we only saw one monthly close in this range; the rest were below it.

August, with a close just above $59,000, was the weakest in the series. Still, the close remains above the 10-month average, which has sharply guided the price through bull and bear markets over the past eight years. Only at the end of 2019 and the beginning of 2020 did the price fall below it, after which the bull market continued.

The momentum indicator at the bottom is still green, although its strength is waning. An end to the correction in September or October would prevent us from slipping into the red.

This correction is beginning to resemble the sideways period of summer 2023. Back then, the price was stuck between $25,000 and $32,000 for more than seven months. It ended in October with a series of rapid increases, rising above $40,000 in December and over $70,000 in March.

The sentiment also shows similarities to last year. We started off relieved that the bear market was over and ended with a mix of doubt, concern, and boredom. There was so much good news, and yet the price kept stalling. Now we are seeing a similar emotional pattern. We began with excitement and optimism about the ETFs and the all-time high, but now doubt and concern are creeping in again.

History never repeats itself exactly, but we are once again seeing favourable forces come together in the fourth quarter, such as looser monetary policy and seasonal effects on the crypto market. The fourth quarter has been the strongest quarter over the past 12 years. While not a guarantee, it's certainly not meaningless either.

News Overview

About 20 years ago, Yale economist Keith Chen conducted a fascinating experiment in which he introduced capuchin monkeys to the concept of money. The idea was simple: the monkeys were given plastic tokens to buy food. They quickly understood how the system worked, learning not only that different types of food had different prices but also that prices could fluctuate. Like humans, they responded rationally to changes in wealth and prices, but when things became more complex—like taking risks—they made the same irrational mistakes as we do.

What made the experiment even more remarkable was how quickly the monkeys started using their new "currency" for everything, even things the researchers hadn't expected. They began using money not just for food but also discovered that they could trade it for other services, including sex. This shows that once something is tradable, there will always be someone willing to trade it. A lesson that applies to both monkeys and humans.

If even monkeys understand that everything is tradable, what does that say about us? In the world of crypto and DeFi (decentralized finance), we see the same behaviour. People are willing to trade anything, from obscure tokens to digital assets, even when they barely understand the risks. The urge to trade is deeply ingrained, whether it’s monkeys playing with tokens or people jumping into the latest meme coin.

This brings us to a new project by the Trump family. Led by sons Eric Trump and Donald Jr., they are working on a new DeFi platform called World Liberty Financial. The platform promises to challenge the banking system and create financial equality. But let's be honest: the question arises whether this is just another way to monetize their popularity and fame. Just as the monkeys got caught up in their impulses, it seems that using the Trump name in the crypto world has the same effect on investors.

Is it a good idea for former President Trump to use his fame for this? Probably not. In a world where people instinctively see value in everything, using a well-known name can quickly lead to unrealistic expectations and deception. Early signs of what is being built and who is involved are not promising. According to CoinDesk, it’s a copy of a platform that was hacked just a few months ago. The team behind it has been hired by the Trumps, and one team member apparently has a background primarily in the dating world.

In the monkey experiment, the tokens were eventually taken away when it became clear they couldn’t handle the complexity. Perhaps it’s time we humans do the same with certain crypto initiatives.

💡 Crypto savings plan

Spread your purchases over a longer period and invest in crypto without actively engaging yourself in it. This investment strategy is known as Dollar Cost Averaging (DCA). With it, you invest at an average purchase price, reduce risk, and gradually build up your position.

Want to buy crypto assets periodically and automatically? With the crypto savings plan, it's easy to do. All you have to do is make sure there is sufficient balance in your account.

Other news:

- Telegram held $400 million in digital assets last year. According to the Financial Times, the company also derived nearly 40% of its annual revenue from crypto-related activities. The in-app wallet is reportedly the main driver, allowing Telegram users to store, send, and trade cryptocurrencies. The sale of "collectibles" also plays a role, specifically in trading usernames and virtual phone numbers.

- SEC warns OpenSea of impending trouble. Once the most popular platform for trading NFTs—tokens representing things like artwork, in-game items, photos, profile pictures, and access passes—OpenSea is now in the crosshairs of the SEC. The regulator classifies some of these tokens as securities and accuses OpenSea of neglecting the responsibilities that come with that. The NFT platform expects the issue to lead to a lawsuit and says it will vigorously defend itself.

- Russia plans to use crypto payments to circumvent international sanctions. A new law signed by President Putin allows the use of cryptocurrencies for cross-border transactions. Within Russia, crypto is still banned as a payment method. Experts are skeptical about whether this will successfully evade sanctions. The traceability of blockchain transactions poses a significant obstacle, as do secondary sanctions imposed on countries that do business with Russia this way.

Behind the Scenes

At Amdax, we innovate to better serve our clients with new solutions. That's why we're proud to introduce Novelist, our new wealth management service for the next generation of investors.

We understand that managed investing starting at €100k isn’t accessible to everyone. That’s why we’ve developed a solution that allows you to start investing from just €500. With Novelist, you’ll receive a recommended crypto portfolio tailored to you. Additionally, you’ll gain insight into all the decisions we make via short video updates, so you’re always aware of what’s happening with your money and why.

We’re launching Novelist later this year. Want first access to the app? Sign up for the waitlist. Know others who are interested? Refer five friends or family members and get a year of free investing with Novelist!

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.