Global South leader in terms of crypto-adoption

6 September 2023

Recently, blockchain company Consensys asked people worldwide what they think about Web3. Do they know the term? Do they have a need for it? Are there regional differences? You can read the answers, and more, in this Weekly!

Cryptomarket

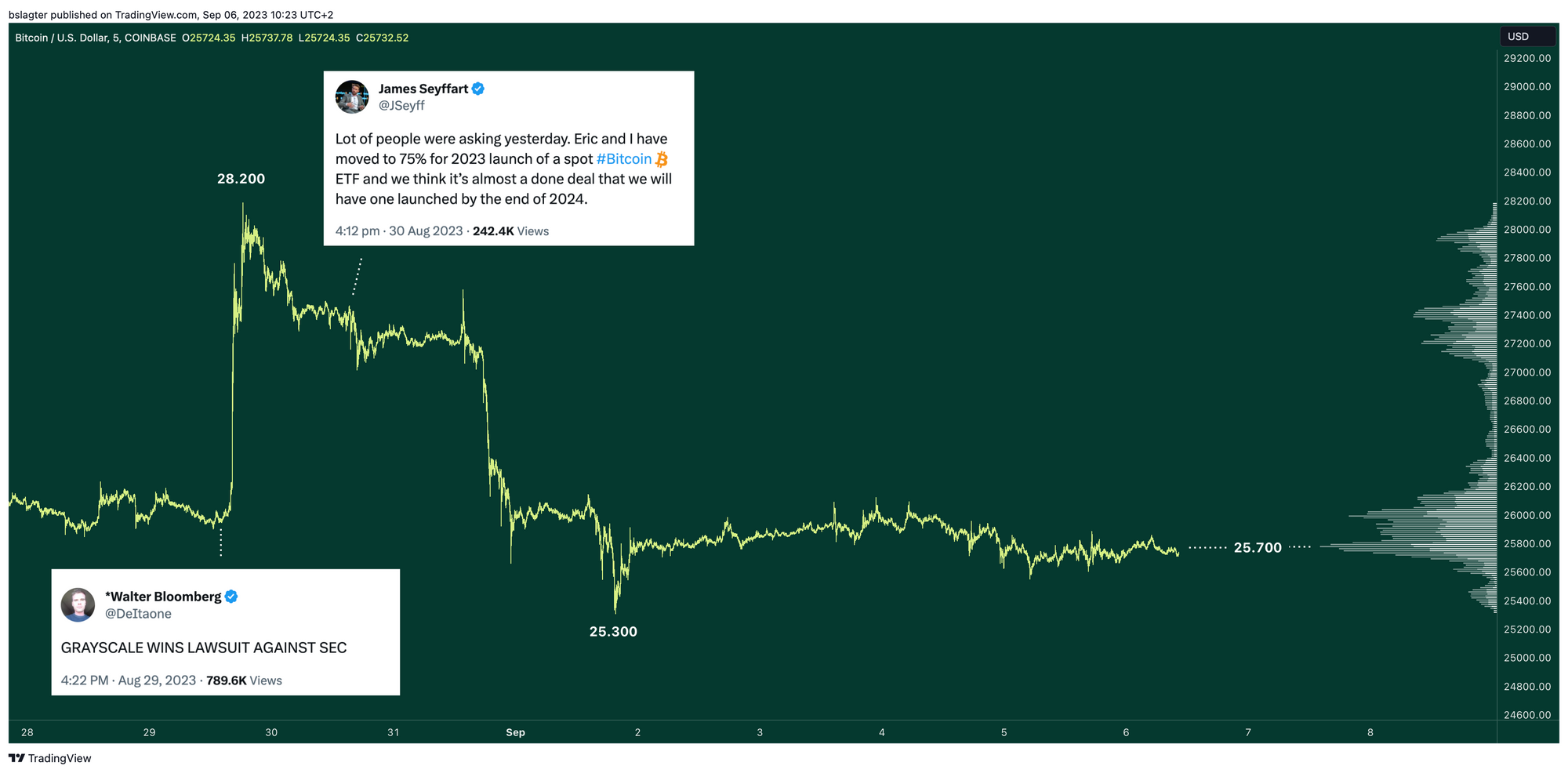

Last week Tuesday, the bitcoin price soared $2,000 to $28,000 in a short period of time after the judge issued a ruling favourable to Grayscale in its case against the SEC. The regulator should not have rejected Grayscale's request to convert its bitcoin fund into an ETF with the arguments it used.

This ruling could also increase the probability of BlackRock's ETF application. Until last Wednesday, Bloomberg ETF watchers saw a 65 per cent chance of the SEC approving a spot ETF in 2023. In doing so, they had already factored in a likely gain from Grayscale.

On Wednesday, they raised the odds to 75 percent for spot ETF approval this year and 95 percent for approval in 2024. The reason for this move was the unanimity of the three judges and the sharpness of the wording.

Still, Tuesday's share price rise did not prove long-lived. The share price started falling again as early as Wednesday afternoon. Slowly at first and increasingly fast on Thursday afternoon until finally a low of $25,300 was reached. Tuesday's entire rise had been reversed two days later.

This is bad news for the bulls. They would have liked to see a monthly close above $27,500 before resuming the bullish trend, a price level where some key moving averages converge. This could be followed by a return to $29,000, the price we saw for much of the summer. And eventually, a price above $32,500 would take us above the price range of the past five months.

That scenario now seems far away. August closed with an 11 per cent loss at $25,900. A final hold is the horizontal level around $25,000 that has been a pivot point so many times in the past year and a half. On 15 June, we came briefly below it, with a bottom of $24,800 just before BlackRock's ETF filing.

Looking only at technical indicators, the risk has increased that we are in for a weak autumn. But a single event could turn the tide quickly. And here, of course, we think primarily of the approval of a spot ETF in the US. The next stop is presumably mid-October. By then at the latest, we will hear more from the SEC!

News summary

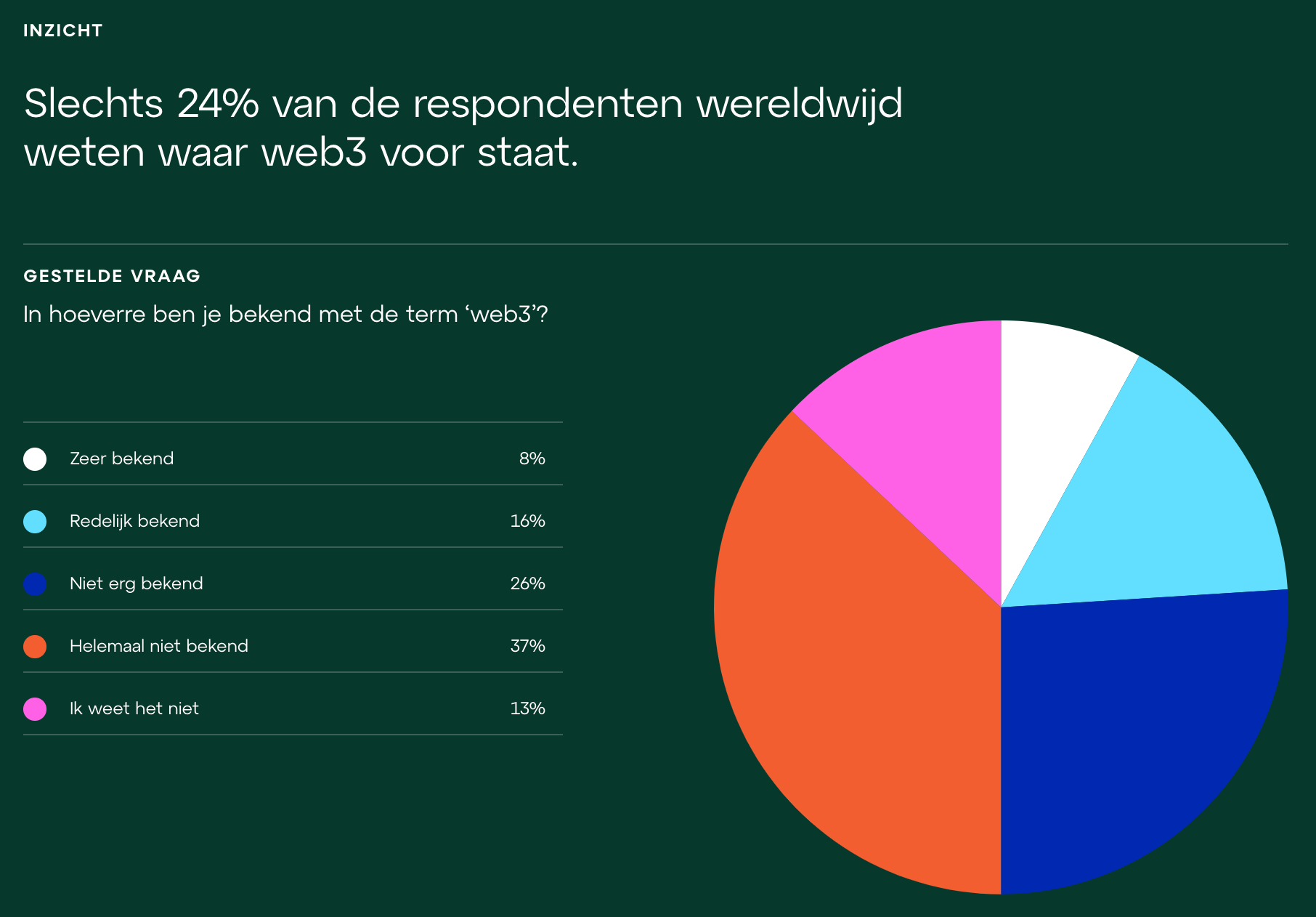

In April, Consensys sent YouGov researchers out with 32 questions about Web3. Over two months, they found more than 15,000 people willing to answer them. The respondents came from 15 countries, spread across all continents, and were selected in such a way as to be representative of the entire population. The results? Those were published this week.

Before we dive into that, a bit about Web3. This term stands for a new iteration of the internet, in which concepts such as decentralisation, blockchain technology and token-based economies play a leading role. The first to use the term was Ethereum founder Gavin Wood. Years later, interest in it grew, partly due to the influence of large tech companies and venture capitalists.

We don't give this explanation lightly. Consensys' survey shows that people worldwide are aware of the existence of crypto assets (92 percent), but few are very familiar with the term web3 (8 percent). This also means that most people are unfamiliar with its potential in terms of privacy, identity and digital assets.

Once familiar with the term web3, it is striking that many people value it. Half of those surveyed believe it stands for a better internet and two-thirds think they should own what they produce on the internet. More than 80 percent of respondents have concerns about data privacy, 70 percent think they are entitled to a share of the profits companies make from their data, and almost 80 percent want to have more control over their online identity.

The results also confirm a much-cited distinction between the West and the Global South. Europeans show a greater degree of scepticism towards crypto. They are more likely to associate it with negative concepts like scams, money laundering or speculation. People from countries in Southeast Asia, South America, the Middle East, and Africa generally have a more enthusiastic attitude. They associate it with the future of money, digital ownership, or alternatives to the traditional financial system. In Argentina and Nigeria, it is notable that people see crypto as access to global capital and inflation protection.

This underlines once again that there is work to be done in the Netherlands and Europe to achieve a paradigm shift. Consensys sees web3 as an indispensable part of the solution to several important and persistent problems. Internet users can exploit them themselves, but that requires them to start looking at crypto through different glasses.

Other news:

Customers of KEB Hana Bank will be able to deposit their crypto there next year. The bank is one of South Korea's largest financial institutions. The new proposition was announced during Korea Blockchain Week in Seoul. In total, the bank manages nearly $450 billion in assets. To store crypto assets, the bank will partner with BitGo.

Australian cardiovascular institute trades cloud storage for Filecoin. The Victor Chang Cardiac Research Institute (VCCRI) employs more than 230 researchers and 23 laboratories. To store all the data they generate, the institution used cloud services. These have now been replaced by Filecoin, a decentralised network for storing large amounts of data. In the case of VCCRI, this involves 137 terabytes of research data. In total, there is now 1.7 million terabytes of data on Filecoin.

Former SEC chairman calls arrival spot bitcoin ETF inevitable. Jay Clayton commented on television on the outcome of the lawsuit between Grayscale and the SEC. In it, the regulator suffered a telling defeat. Clayton: "It is clear that bitcoin is not a security (security). It is also clear that retail investors want access to it. That institutional investors want access to it. And, more importantly, some of our most trusted asset managers want to offer this product to the general public. I think [...] adoption is inevitable."

Deepen

Analyst Lyn Alden, well known in the bitcoin world, has written a book: Broken Money. In it, she writes about the rise of money, the different ways money can break down, and how bitcoin differs from the money systems we have had so far. In the podcast What Bitcoin Did, she explains this storyline in three one-hour parts. Listenable!

Achter de schermen

Anyone who has ever tried it knows that storing your bitcoin and other crypto assets yourself is not that simple. That is why Amdax has elevated this to an art. We follow strict procedures and use advanced techniques to safely store your assets. With us, outstanding balances are always covered by reserves in the vault and your crypto assets are never lent out.

We see it as our mission to minimise risks for our clients. We do this with the highest security standards and personal guidance for our clients. With your crypto assets under management at Amdax, your assets are safe and you no longer have to worry about theft, loss and your estate.

Do you also want to put your assets in safe hands? Then contact us via this page:

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.