Ether is lifted by ETF rumors

22 May 2024

The tranquility of the Pentecost weekend turned out to be no harbinger for the crypto week that followed. Suddenly, excitement arose around Ethereum. The US regulator is said to have changed course and is considering approval of the applications for spot ether ETFs that are currently on the table. More on this in this Weekly. But first: the market update!

This Weekly in brief:

- Market: The entire crypto market rallied after sudden rumors of potential approval of spot ether ETFs. Bitcoin rose to nearly $72,000, the highest point since early April. Ether surged 35% in a week to $3,850.

- News: This week, US financial institutions will find out if their requested spot ether ETFs will be approved. Various ETF specialists anticipate approval, an assessment that suddenly turned in favor of ether on Monday.

- Behind the scenes: As a partner, we had the opportunity to provide the members of the Company Golf Club with a lecture last week on crypto as an interesting option in an investor's portfolio!

Market update

We start this week with ether. The currency of the Ethereum network surprised everyone with a 35% jump from $2,850 to $3,850. The cause of the surge is a renewed belief in the imminent approval of a spot ether ETF.

Analytics firm Kaiko also reported a 30% increase in ether futures' open interest to a new record of $11 billion. Funding rates have also risen sharply, according to analysts, signaling a return of bullish sentiment.

It was striking that not only ether made a leap, but the entire crypto market did. For example, the price of bitcoin rose from around $66,500 to $71,900, the highest point since April 9. This is because the potential approval of the ether ETF is linked to a potential turnaround in US politics. That changed stance is then positive not only for ether but for the entire crypto market.

Whether this is indeed the case remains to be seen. Nevertheless, this positive impetus has temporarily broken the downward trend for many assets: after a series of two months with lower highs (LH) and lower lows (LL), we now see a higher high (HH).

This does not mean that we have now passed the correction. We can only speak of that when prices are above $73,800 for bitcoin, $4,100 for ether, and $210 for Solana. Until then, the option of a longer sideways movement remains open.

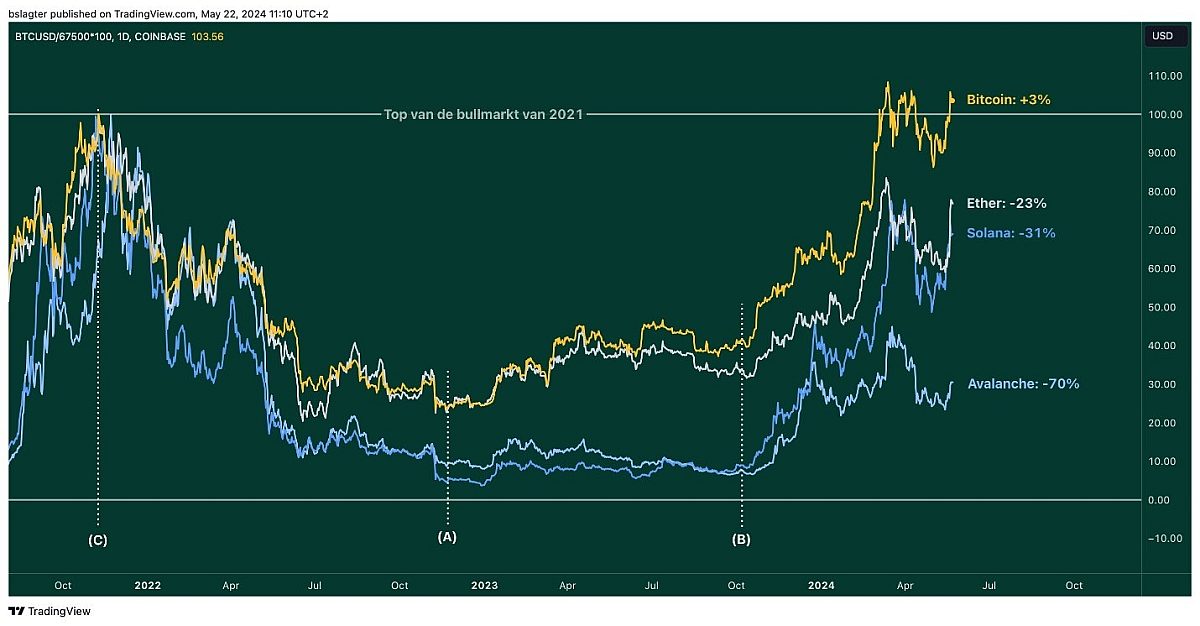

Among investors, there has been dissatisfaction over the past six months regarding ether's performance compared to bitcoin and solana. There are two perspectives on this.

Firstly, you could look from the bottom of the bear market in November 2022 (A) or from the beginning of the bitcoin ETF rally in October 2023 (B). In both cases, ETH has performed worse than SOL and BTC. But even, for example, Avalanche, which ranks lower on the list, performed better.

Secondly, you could look from the top of the bull market in 2021 (C). And then a completely different picture emerges. In the chart below, we have aligned the peaks of BTC, ETH, SOL, and AVAX and plotted the price developments since then.

You can see that the significant increases in SOL and AVAX from points (A) or (B) are still insufficient to make up for the enormous decline in the bear market. ETH and BTC both saw declines of around 75% in the bear market, while many other crypto assets had to undergo declines of 95%.

"We often say, 'Narrative follows price'." The enthusiasm for the Ethereum ecosystem could increase significantly if the price of ether continues to rise in the coming months. If that happens, ether turns out to be not only a good investment in the bear market but also in the bull market.

News overview

The shift in sentiment surrounding Ethereum is palpable in the market. It happened on Monday when analysts closely monitoring the situation suddenly adjusted their odds upward out of the blue. "James Seyffart and I are raising our estimate from 25% to 75%," writes Bloomberg journalist Eric Balchunas. "We hear through the grapevine that the SEC may be making a 180-degree turn. The issue is becoming more and more political."

If it's true that the SEC is making a political U-turn, there's a good explanation for it.

Last week, the US Senate put an end to a controversial plan – SAB 121 – proposed by the regulator. SAB 121 would have restricted banks' participation in the crypto market. The bill to invalidate that plan had already been passed by the House of Representatives and was now with the Senate. It also garnered support there, even among Democratic senators. Out of the 48 Democrats, 12 voted in favor of the bill, which was passed with a total of 60 vs. 38 votes. "We are so ₿ack," Senator Cynthia Lummis tweeted to celebrate the victory.

The outcome is that the regulator has been overruled by America's main political bodies. Additionally, the Democratic Party has sent a clear signal from within to figures like Elizabeth Warren and President Biden. Support for their fight against the crypto market has diminished. "At least follow the proper democratic processes," dissenters tell Politico journalists.

It seems that the relationship between US politics and the crypto market is slowly changing. The approval of the first spot ether ETFs would be a clear sign of this shift. The next hurdle is the FIT21 bill, which aims to provide clarity on the classification of crypto assets. If this proposal makes it through the political process, it would be a significant breakthrough after years of discussion, hearings, and political struggle.

In the crypto world, these developments are already being celebrated as a definitive victory. However, ETF specialist Nate Geraci argues that this may be premature. His theory is that the SEC has simply remained silent until the end of the application process. "They have learned from the Bitcoin era. I don't think political considerations played a very significant role here."

If the ETF applications are approved, it does not necessarily mean that the new funds will be tradable the next day. Unlike the bitcoin funds opened in January, the applicants still need to make their preparations. "There will be at least days between approval and launch," writes Bloomberg specialist James Seyffart. "But it's likely to be weeks or months."

Generate extra returns on your ether tokens

With Ethereum staking, you generate additional returns on your Ethereum, which can amount to up to 3.5% annually. At Amdax, we make Ethereum staking available to everyone, with no minimum deposit. We handle all technical challenges and always stake your ETH tokens securely from our vault, with no counterparty risk.

Other news:

- Leading American pension fund invests in bitcoin. Last week, the State of Wisconsin Investment Board (SWIB) revealed a significant position in bitcoin funds. The pension fund invested $99,167,688 in BlackRock's ETF (IBIT) and $63,687,310 in Grayscale's (GBTC). It is rare for such a large institutional fund to invest in a new asset class so early in its lifecycle.

- The verdict portrays Craig Wright as a fantasist and liar. The British judge overseeing the lawsuit between COPA and Wright has laid out his verdict in detail. Wright lost the case on all counts. "He presents himself as an extremely intelligent person. But he is not nearly as clever as he thinks he is," writes the judge. "I am fully convinced that Wright extensively and repeatedly lied to the Court."

- Stablecoin company Circle plans to move headquarters to the US. The company aims to go public and prefers to do so in America. It is noteworthy that influential (former) politicians are increasingly defending and emphasizing the role of stablecoins. At the same time, rumors are circulating that the Biden administration is preparing steps against Tether.

Always stay up to date?

Subscribe to the Amdax Weekly and receive a new Weekly in your mailbox every Wednesday.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.