Crypto Market Finds Support at a Key Level

11 September 2024

For many investors, the downturn in financial markets has lasted longer than expected. And where prices fall sharply, concerns grow. At the start of this week, those concerns gave way to relief, led by a quick recovery in the price of bitcoin. Is this a reason for optimism, or should we remain cautious? More on that in this Weekly!

This weekly in brief:

- Market: After a significant drop to $52,600, bitcoin's price recovered earlier this week to around $57,000. Ether found support in the important zone around $2,150 and is now at $2,350.

- News: Even in a sluggish market, there's one entity easily posting green figures: Tether. More than $118 billion of this stablecoin has been issued so far. And it's paying off handsomely: profits of $6.2 billion surpass those of asset manager BlackRock.

Market Update

Last week, cryptocurrency prices dropped significantly, alongside global stock markets. The price of bitcoin hit a low of $52,600 on Friday evening, the lowest point since the sharp drop on August 5. The sentiment was gloomy and pessimistic.

However, there are also some encouraging signs. Many coins found support at key price levels. ETH at $2,150 and SOL at $125, for instance. There was also bullish divergence, a combination of lower closing prices and higher values on momentum indicators. This signals that the strength of the downward trend is weakening.

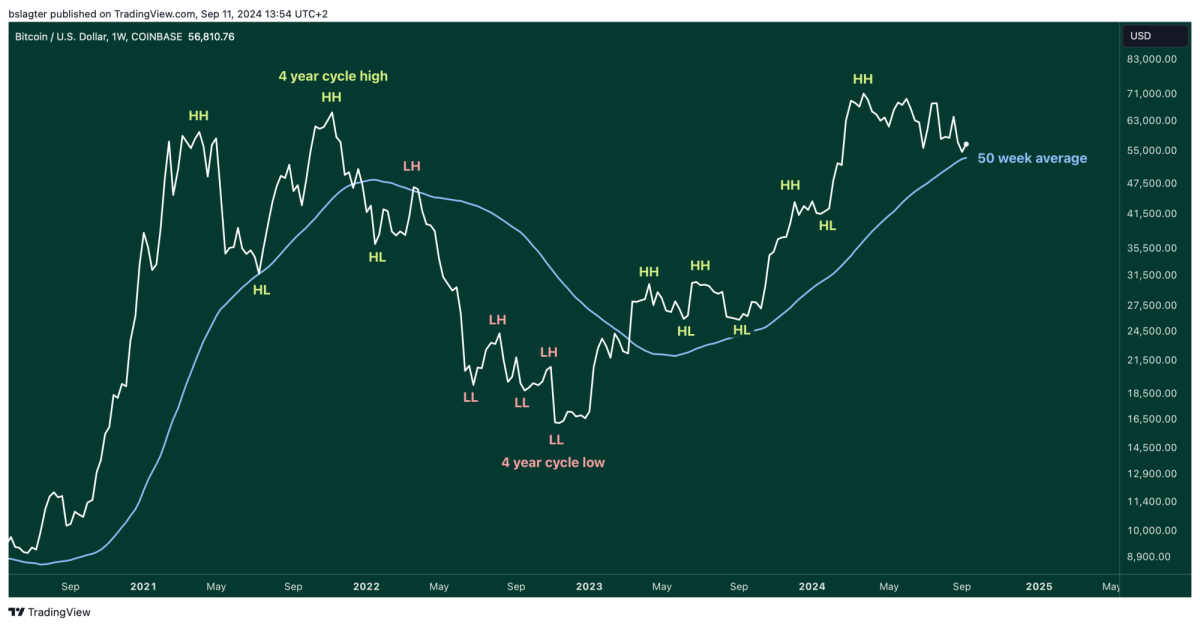

Below is the weekly chart of bitcoin in dollars. The 50-week average acts as an early division between bull and bear markets. You could say this average guide rising and falling trends. A weekly close below it is a clear sign of weakness in an uptrend. That hasn't happened yet, with last week's close neatly above this line.

A key feature of an uptrend is a series of higher highs (HH) and higher lows (HL). The upward trend on the weekly chart is still intact. Only if the price falls below $38,500 would the series end. In short, it was a painful week with a hopeful end.

The correction in the cryptocurrency market has now lasted nearly six months. For many investors, this is a disappointment, as they had expected a continuation of the uptrend much earlier. The fact that gold and stocks have set new records several times in recent months makes it even more painful.

The price of ETH is now 44% lower than its peak in March and still 51% below the all-time high of $4,800 in the 2021 bull market. ETH, like most other altcoins, is underperforming compared to bitcoin. This indicates that risk appetite among crypto investors remains limited in this market cycle.

The zone around $2,150 has played an important role in recent years, first as resistance and then as support. On August 5, the price dropped precisely to this area, and last Friday, it stopped there again. A trend reversal in the next two weeks would be welcome.

News Overview

Some technologies move too fast for regulations. They burst out of the starting blocks, conquer the market, and grow so quickly that laws can only catch up later. The classic example? Uber. They launched without regard for existing taxi laws. First came the customers, then the regulatory conflicts, and finally the adjustment of the rules. Airbnb followed the same path: popularity first, then the discussion about permits and taxes.

This pattern is common. Napster, the infamous music-sharing platform, revolutionized the music industry, even though it was eventually brought down by lawsuits. However, Napster laid the groundwork for services like iTunes and Spotify, which were able to thrive legally because the technology had already changed the culture.

Then there are stablecoins, a recent player in this story. Tether, perhaps the most prominent, grew into the world's largest stablecoin simply by not asking for permission. If Tether had asked the U.S. government if it could issue digital dollars without fully identifying customers, the request would likely have been denied. After all, stablecoins clash with the foundations of the modern banking system.

But Tether didn’t ask. And now look: more than 118 billion of them are in circulation. In 2023, it generated a whopping $6.2 billion in profits, more than BlackRock, the world's largest asset manager. Per employee, Tether is one of the most profitable companies ever, a statistic Nate Geraci aptly summarized yesterday: “This is the most astonishing thing in crypto right now.”

Tether's success is remarkable, especially considering it operates without formal regulatory approval. Yet, the U.S. seems to accept it as long as the company cooperates with measures like blocking suspicious accounts. However, this balance is fragile.

The question now is: will Tether end up like Napster, with a glorious but short-lived period of dominance, or like Uber, where the rules bend to accommodate its success? That remains the uncertain future of Tether and stablecoins in general. Regulations are coming, but whether they will allow Tether to continue growing is yet to be seen!

💡 Crypto savings plan

Spread your purchases over a longer period and invest in crypto without actively engaging yourself in it. This investment strategy is known as Dollar Cost Averaging (DCA). With it, you invest at an average purchase price, reduce risk, and gradually build up your position.

Want to buy crypto assets periodically and automatically? With the crypto savings plan, it's easy to do. All you have to do is make sure there is sufficient balance in your account.

Other news:

- Japan’s three largest banks plan to use stablecoins for cross-border payments. This initiative, called Project Pax, focuses on a private network between financial institutions, not public stablecoins. It competes with services like Ripple and Agorá, a project launched by the BIS for transactions between central banks.

- Zürcher Kantonalbank is launching services related to bitcoin and ether. Switzerland's second-largest bank announced that it will initially offer trading and storage of cryptocurrencies. The services will be available to both direct customers and third parties, fully integrated into the bank’s applications for Internet and mobile banking.

- Robinhood has agreed to pay nearly $4 million in fines for misleading customers. The penalty is part of a settlement with California authorities, who found that the company wrongfully restricted its customers. Users couldn't withdraw their purchased cryptocurrencies and were forced to sell back to Robinhood at inflated prices. The company promises improvements and is “glad to put this episode behind them.”

Deepen

How Crypto Is Transforming Argentina's Economy

Maybe this sounds familiar: you tell someone about crypto, and the first question they ask is, “What’s the point of that bubble?” A striking example can be found in Argentina, where cryptocurrencies have been widely adopted. At the end of August, three speakers discussed this in the podcast Bankless, telling a story about the "crypto revolution" in Argentina!

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.