Concerns depress crypto market

26 June 2024

The cryptocurrency market is currently subdued. Various news events are being cited as reasons for the weak market, such as the German government selling seized bitcoins. But do these events truly explain what's happening? More on this in this Weekly!

This weekly in brief:

- Market: Last Monday, the Bitcoin price briefly plummeted by several thousand dollars to a temporary low of $58,400. A swift recovery pushed the digital gold back above the $60,000 mark.

- News: German authorities have sold a small portion of bitcoins seized in 2013. Additionally, a years-long saga is nearing its end: Mt. Gox creditors will be repaid in July.

- Behind the Scenes: On Wednesday, July 3, from 8:00 PM to 9:00 PM, we are hosting a webinar titled ‘Why a Modern Investment Portfolio Needs Crypto’. Register now!

Market Update

Over the past three weeks, the price has dropped 14% from $72,000 on June 7 to $62,000 now. Particularly at the beginning of this week, the descent was dramatic. On Monday, June 24, the price fell sharply from $64,000 to a low of $58,400, after which it quickly recovered and stabilized around $62,000.

This drop brought us for the second time into a price range where we have been oscillating for nearly four months, with a ceiling at the record price of $73,800 and a floor at the neat round number of $60,000.

The current period of consolidation increasingly resembles that of last summer, when the price moved sideways for more than six months, twice visiting the bottom of the price range. Similarly, the largest cryptocurrency has dipped below the 50-day average twice, as is the case now.

Various news events, such as the German government's sale of seized bitcoins, are being cited as reasons for the weak market. However, this involved only a few thousand bitcoins and occurred last Wednesday and Thursday. It appears to be concerns and uncertainty that are pushing the market down, rather than the facts themselves.

But sentiment and narrative follow the price: if the price rises sharply after a low, worries are quickly forgotten. The market then looks optimistic again, citing, for example, the launch of Ether ETFs and billionaire Michael Dell's interest in Bitcoin as reasons.

Investors who have held Bitcoin in their portfolios for a while may be surprised by the pessimism, given that the biggest correction in the past year and a half was just 23%. In previous bull markets, drawdowns of well above 30% were quite common.

The explanation might be that the rest of the cryptocurrency market is faring much worse than Bitcoin. The total market value of all altcoins outside the top-10 has lost more than 40% compared to the peak. Here, the price has also fallen below longer-term averages, such as the 200-day average. Bitcoin and Ether, however, are still above these levels.

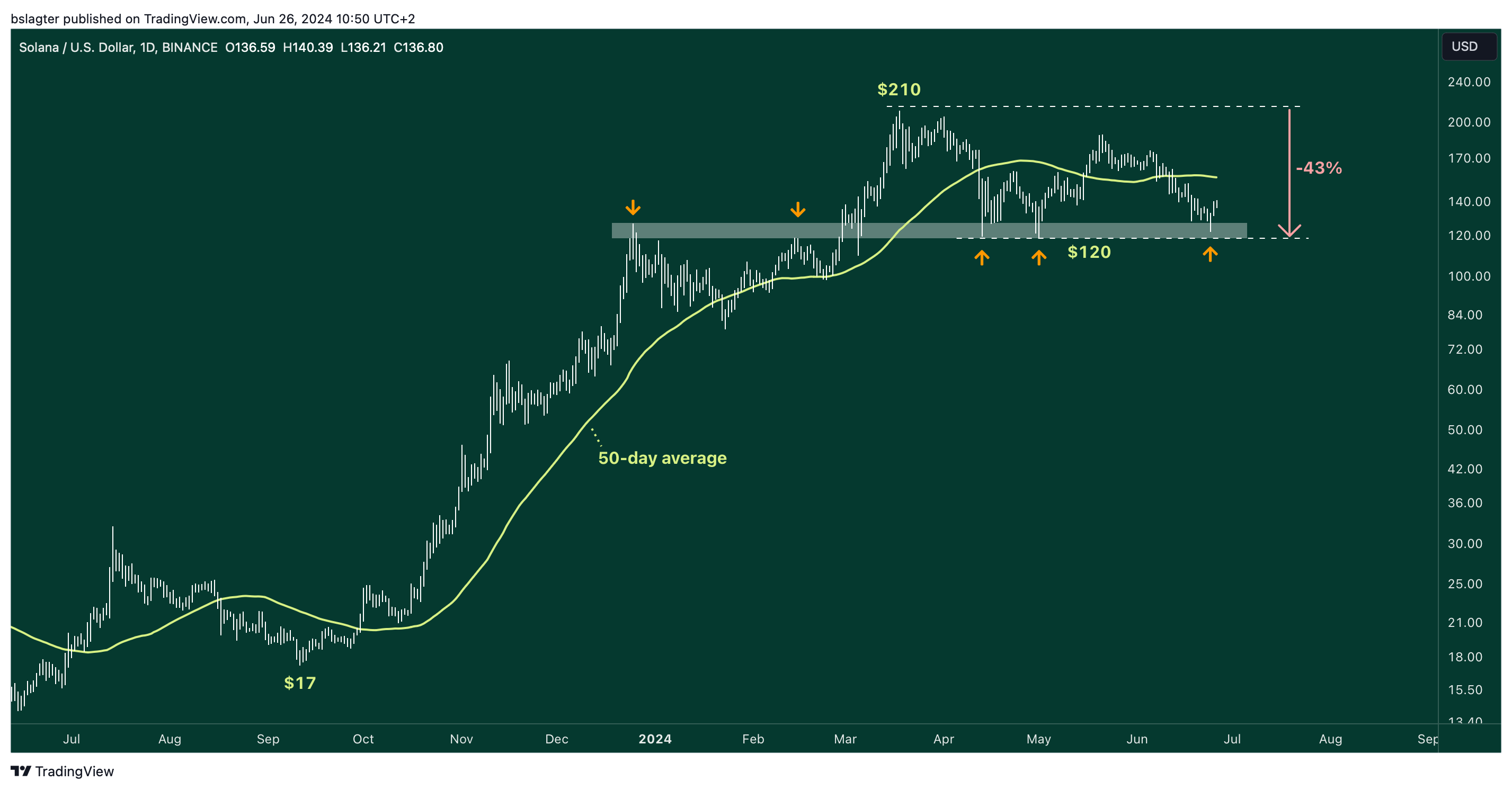

The chart below shows the price of Solana, which is leaning on a zone that has provided support twice before, a hefty 40% below its peak at $210. If this zone does not hold, a significant drop is likely.

Ether is a positive exception amid the altcoin woes. The Ethereum token benefits from the upcoming ETFs and the dismissed lawsuit by the SEC regulator. With a decline of 17% from the peak, its situation is similar to that of Bitcoin. If the market turns in the coming weeks and begins a new period of rising, this could be advantageous for Ether and other projects in the Ethereum ecosystem.

News Overview

While the facts alone did not drive the market down, they played a significant role in the change in sentiment experienced this week. We highlight two events that captured the most attention.

We start with the unrest caused by a wave of sales of 'German bitcoins'.

In 2013, a German (40) and a Polish (37) man were surprised by a visit from a small army of various German authorities, including the Dresden Public Prosecutor's Office, the Criminal Police of Saxony, and the Leipzig tax office. The duo was accused of commercially exploiting copyrighted material and money laundering through the website movie2k.to, which was active from 2008 to 2013 and hosted more than 880,000 illegally copied films and TV shows.

During the investigation, it was revealed that the duo had accumulated tens of thousands of bitcoins through revenues from the website. In total, the suspects voluntarily handed over 50,000 BTC to the police. At the time, this was worth just over $5 million, but now it amounts to billions. The future of the seized bitcoins had been unclear for a long time, partly due to ongoing legal procedures.

In recent weeks, the German authorities have liquidated a portion of the bounty. On-chain analysis indicates it involved about $200 million, a little more than 3000 BTC. This is too little to explain the fall in Bitcoin's price, but enough to cause unrest among investors. What will happen to the rest of the seized bitcoins remains unknown to this day.

We continue with the second worrisome news item for investors. After a 10-year process, creditors of Mt.Gox are finally receiving part of their funds back. The repayment starts in July.

Mt.Gox, you ask? Mt.Gox was once the world's largest Bitcoin exchange, handling more than 70% of all trading volume. The downfall of the exchange began with a series of security breaches. A hack in 2011 led to the loss of 25,000 BTC, and another massive hack in 2014 resulted in the loss of another 750,000 BTC. Eventually, this led to the collapse of the exchange in the course of 2014.

Of the total 950,000 lost bitcoins, eventually, 140,000 were secured. About 65,000 of these are being distributed to individual creditors. When Mt.Gox went bankrupt, Bitcoin was traded at a price of $450 each.

The announcement by the Mt.Gox trustee triggered a classic sell-the-news scenario, says Bitget analyst Ryan Lee to The Block. "The prospect of a temporarily increased supply is worrisome for investors. It is likely that creditors will cash in some of their profits."

It is uncertain whether these recipients will actually dispose of their regained bitcoins. Alex Thorn, head of research at Galaxy, thinks their impact is overestimated. "Many creditors are long-term Bitcoiners who have turned down aggressive bids on their claims for years."

Other news:

- Ethereum is gearing up for ETF launch. Regulators provided the aspiring fund managers with constructive feedback sooner than expected, leading to all updated applications landing in the SEC's inbox by the end of last week. "Six weeks ago, spot ether ETFs were still hopium," writes ETF specialist Nate Geraci. "Now, trading in them could start this week or next!"

- North America's first Solana ETF filed. Fund manager 3iQ is trying to bring the fund, QSOL, to the Canadian market. Some analysts expect that after the launch of the ether funds, the focus will shift to Solana. The company is capitalizing on this with its application. The tokens purchased by the fund are put to work through staking, allowing shareholders to expect an additional 6-8% yield.

- Game developer Konami launches NFT platform on Avalanche. Konami is a well-known name in the gaming world, with titles like Metal Gear Solid, Silent Hill, and Castlevania. The company has unveiled Resella, a platform where in-game items, among others, can be issued and traded as NFTs. Konami states that users do not need a wallet and do not have to perform any 'complicated' transactions. All interactions are paid with Japanese yen.

Deepen

This week Mathijs van Esch was a guest on BNR's Cryptocast. Mathijs works at fund manager Maven 11 and is close to the ball on developments on and around Ethereum, the No. 2 coin in the crypto world. What is the current state of the coin? What impact do second-tier networks have on the system, what does the adoption of ETH ETFs suggest and is Solana the main competitor? The answers are worth listening to; at least the next few years are going to be interesting!

Deepen

This week Jasper and Tim discuss two clouds hanging over the market: the selling pressure surrounding Mt. Gox and the German government.Victims of the largest crypto hack ever can expect to get their lost crypto assets back in the near future.Will this create major selling pressure?

It also came out this week that the German government has sold over 100 million worth of bitcoin.The Germans own a total of 3 billion in bitcoin. Are they planning to sell even more bitcoin? Despite this, we also see many positive developments, especially around Ethereum. We discuss what's going on.

Behind the scenes

On Wednesday, July 3rd, from 8:00 PM to 9:00 PM, we will host the webinar ‘Why a Modern Investment Portfolio Needs Crypto’. Bert and Peter Slagter, Lucas Wensing, and Jasper Oelers will explain why now is the ideal time to invest in crypto. They will also discuss the various ways you can invest and what you should watch out for. This webinar is particularly suitable for beginner crypto investors. Are you interested, or do you know someone who could benefit from an accessible webinar about crypto? Register via the link below!

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.