Bitcoin price peaks due to high ETF expectations

17 January 2024

The price of bitcoin reached above $45,000 again for the first time since April 2022. The hope of a favourable decision from the US regulator seems to be the main driver of this. How sustainable is this rise? More on that in this Weekly!

This Weekly in brief:

- Market: A lot happened in the crypto market this week. After the bitcoin price soared through its highest point in almost two years, we saw a big drop today.

- News: The new year has started, and for Dutch crypto owners, 1 January is an important reference date for determining the value of your crypto portfolio for income tax purposes.

- Behind the scenes: Thanks to a nice update in the My Amdax web environment, from now on it is possible to see the performance of your portfolio clearly in a graph.

Market update

Bitcoin ended the year 2023 at a price of $42,500. That's a 155% increase from the opening price of $16,500. The best annual return since 2020!

This performance caught the eye. Many newspapers and magazines devoted articles to it. The Economist wrote another negative article in late 2022 with alarming headlines like "Crypto's downfall" and "Is this the end of crypto?". The tone is very different in late 2023:

"Not only has crypto survived, it is once again soaring: bitcoin climbed to a two-year high of almost $45,000 on December 11th, up from just $16,600 at the start of the year."

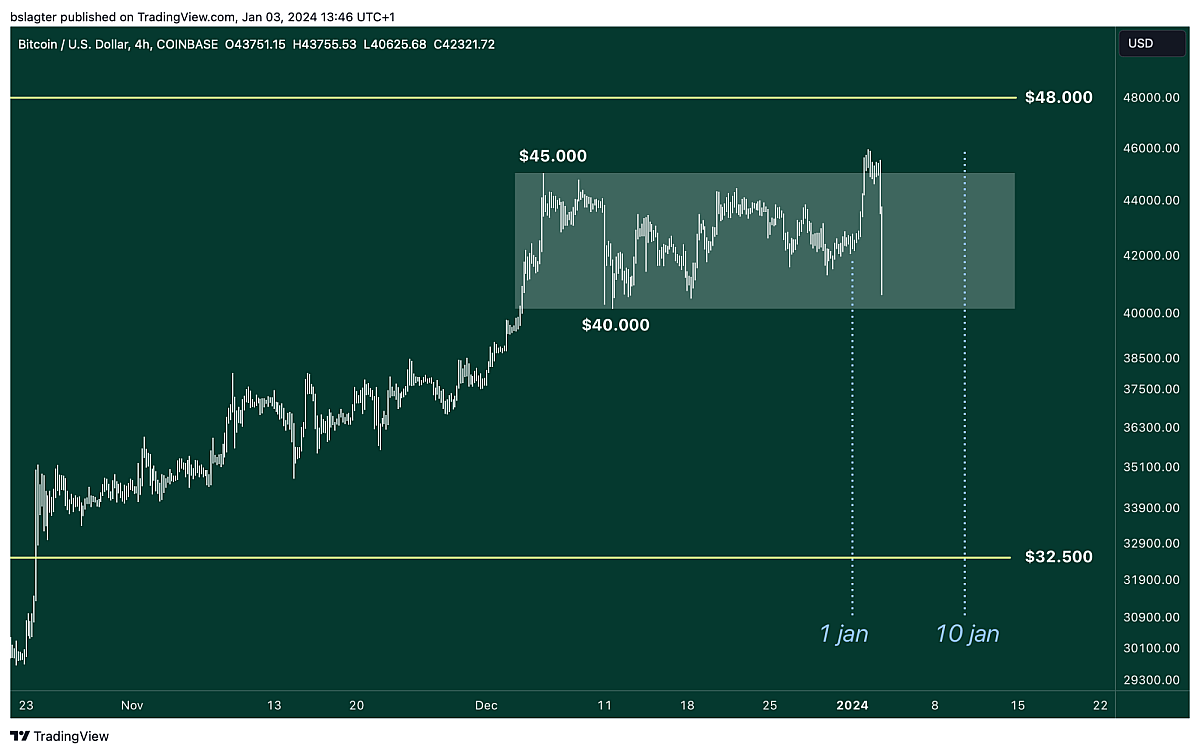

With the rise in 2023, we have almost completely made up for the fall in 2022. That year opened at $46,200. To get a good idea of where the price is, we look at the chart of the past two years. Then we can clearly see the significance of the upper and lower limits of the current price range.

The lower boundary is at $32,500, the dividing line between the 2021 bull market and the 2022 bear market. All the woes of the bear market have played out below this price range. The market took seven months to get through there.

The upper limit is at $48,000, the highest point in the first six months of 2022. At $48,500 lies the golden ratio, exactly 61.8% of the difference between top and bottom, derived from the fibonacci series. In financial markets, we often see price turning or pausing at this level. This also happened in the previous two cycles.

The chart below shows the price of bitcoin in 2022 and 2023, with a signature event written at five pivot points: Luna, Celsius, FTX, SVB and BlackRock. Since June, there has been no such indication. The share price crept up steadily without any major shocks. Will early January provide another caption?

Since early December, we have been in the price range between $40,000 and $45,000. Right after the 2024 opening, we briefly rose to $46,000, but today the price dropped back into the price range with a bang.

Such rapid price movement often has two ingredients: fuel and a spark. The fuel is provided by leveraged traders being forced to close their positions. These liquidations reinforce the movement already under way.

That leveraged trading increased in recent weeks is not surprising. Between 8 and 10 January, regulator SEC is likely to make a decision on the admission of bitcoin ETFs. By speculating on the outcome with leverage, people hope to make a lot of money quickly.

Often that ends in tears. In this case, the spark that started the move was presumably provided by a report from crypto firm Matrixport expecting the ETFs to be rejected.

Interestingly, although the decline was rapid, it also stopped quickly. Bitcoin and ether now stand at a loss of about 5% from a day earlier, returning to roughly the level of 1 January. Apparently, there were enough investors who still have every confidence in the adoption of ETFs, and were willing to buy.

News summary

The turn of the year is over and 1 January is already in the rear-view mirror. This is an important moment for Dutch crypto owners: it is the reference date on which you determine the value of your crypto wallet for income tax purposes.

The Dutch tax authorities say this about it: 'Crypto assets belong to your assets in box 3. You declare the fair market value of your crypto assets on 1 January (reference date). You use the exchange rate on the reference date of the exchange platform used.'

In your income tax return, you use the total value of your portfolio on 1 January of the year for which you file your tax return. In 2025, you will file a tax return for 2024 and for that you will need to know the value of your portfolio as at 1 January 2024 in due course.

It is therefore useful to make an overview every year immediately on 1 January. After all, now you still know exactly which crypto assets you own and it is easy to look up the price. To do this, you take the opening price of 1 January on the trading or custody platform you use. Or the price on coinmarketcap.com if you manage them yourself.

For our clients, we make declaring crypto assets easy. They automatically receive an annual financial statement with the value of all crypto assets on 1 January 00:00. Are you an Amdax customer? Then you will find the 2023 annual statement in your document centre.

Put your crypto assets in the safest hands in Europe

Last year, Amdax passed a prestigious audit and set a new standard in terms of security, transparency and reliability. Want to put the bear market of 2023 behind you once and for all? Then move your crypto assets to Europe's most secure vault.

Other news:

- Congratulations on bitcoin! Today we celebrate bitcoin's 15th anniversary. On 3 January 2009, Satoshi Nakamoto made the first block. The bitcoin network has only been unreachable for a few hours twice since then. The first block contains the now legendary text: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks".

- Tether takes in 8888.88 BTC from the Bitfinex exchange. This is according to data from BitInfoCharts. The company is now number 10 on the list of largest bitcoin holders. In total, the company owns 66,465.2 BTC worth $2.8 billion. MicroStrategy owns 189,150 BTC after its latest purchase, whose average purchase price is $42,110.

- US government drops second criminal case against Sam Bankman-Fried. The US government apparently finds it unnecessary to pursue further charges of bribing executives and politicians. Prominent figures in the crypto world call the decision a major scandal. At the end of March, Bankman-Fried will hear for how long he will disappear behind bars.

Deepen

Een Nieuwe Koers - Market update

In the first episode of 2024, Ies and Tim discuss the rising price of bitcoin. This week, the bitcoin price reached its highest point since April 2022. Altcoins also continue to find their way up.

Next, we take you through rising funding rates. What are funding rates and why are they rising so fast right now? Microstrategy has bought another pick of bitcoin. Michael Saylor's software company is fast accumulating 1% of the total amount of bitcoin available.

Behind the scenes

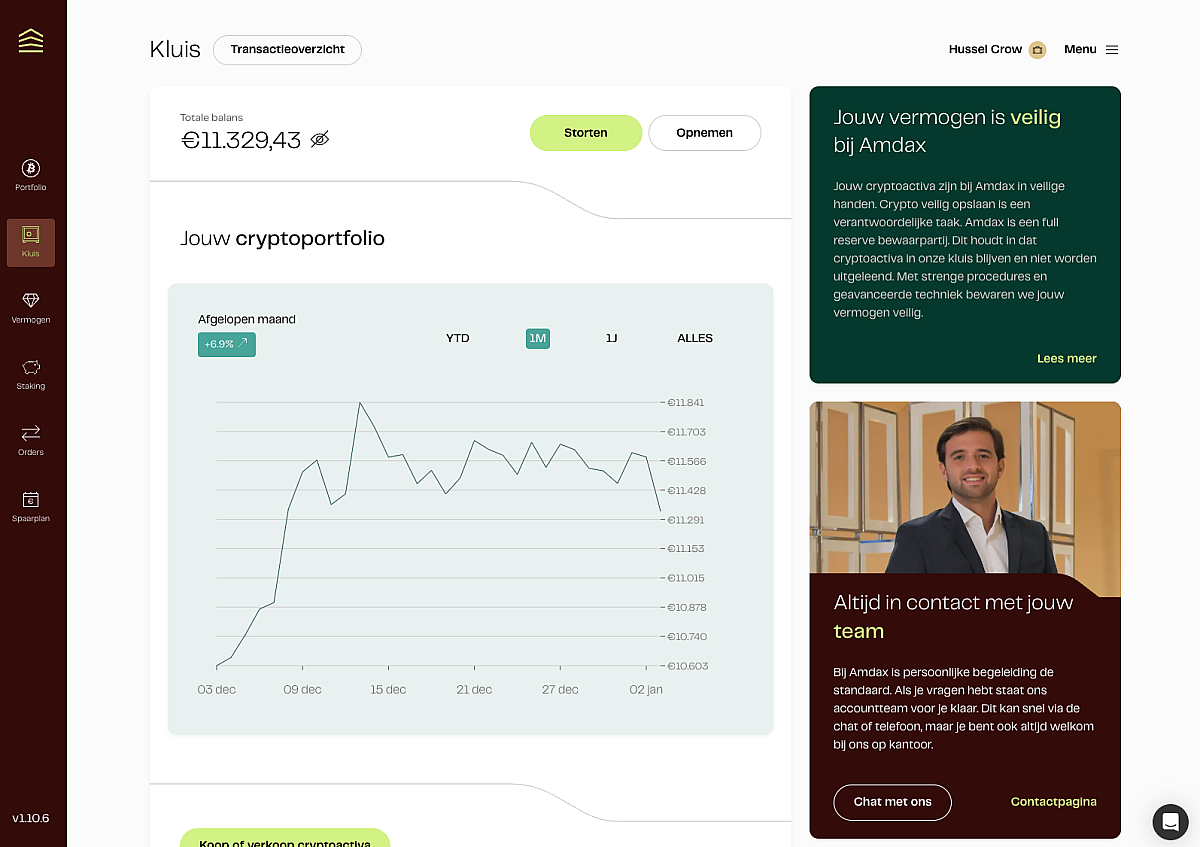

Behind the scenes, our Product and IT team is continuously developing the My Amdax web and app environment. Recently, the performance graph was integrated into the web environment, giving you constant insight into the results of your crypto portfolio. A great update!

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.