Bitcoin has passed its halving, now what?

24 April 2024

A week ago, the

cryptocurrency market geared up for the fourth halving. In the night from

Friday to Saturday, it finally happened, and now the fifth so-called reward era

is already four days old. How did the halving go? And what's on the agenda

next? That, and more, you'll read in this Weekly!

This Weekly in brief:

- Market: The cryptocurrency market is still in correction mode. The price of bitcoin is moving sideways in a price range between $60,000 and $74,000. The halving caused a spike in transaction fees due to the launch of Runes. The worst turbulence seems to be behind us.

- News: After the halving, attention around bitcoin shifts to price predictions. These predictions vary widely, from a conservative $90,000 to over $600,000.

- Behind the scenes: We look back on a successful Halving Party and are excited to share a new update in the My Amdax environment with you!

Market update

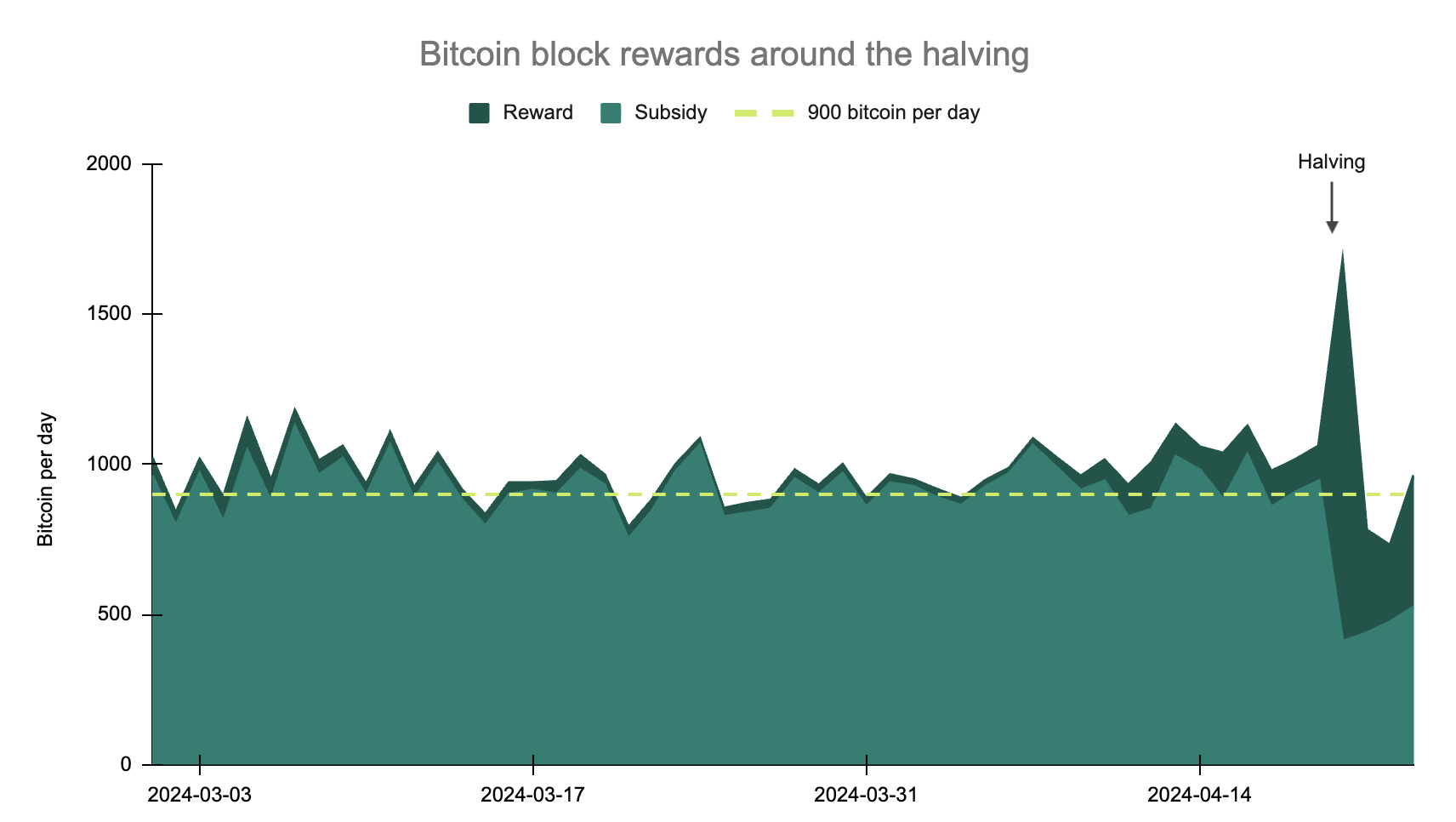

Early in the night from Friday to Saturday, it happened. Block 840,000 was added to the bitcoin blockchain. In one go, the reward miners receive for their work was halved, from 6.25 BTC to 3.125 BTC. The halving that has been anticipated for the past few months.

This halving was special due to the launch of Runes. It served as the starting gun for this new token protocol on bitcoin, which has attracted the attention of large groups of speculators in recent months. They see the opportunity to move the online casino to bitcoin, hoping to make a good profit from the memes and stories that surround it.

In the world of memes, being the first has value. For this reason, the first block of the fifth era was in high demand and filled with transactions that brought the first bitcoin tokens to life. A hefty price was paid for this. In total, for that one block, 37.6 BTC, now almost $2.5 million, was paid in transaction fees. That's 36 times more than what was paid for space in the previous block.

For miners, the halving has remained lucrative since then. For more than 100 blocks after the halving, the paid transaction fees were higher than the subsidy miners are allowed to pay themselves. Structurally, more than 1 BTC is still being paid in transaction fees. So far, miners have not suffered much from the halving. However, it is not expected that transaction fees will structurally make up for the lost 3.1 bitcoins.

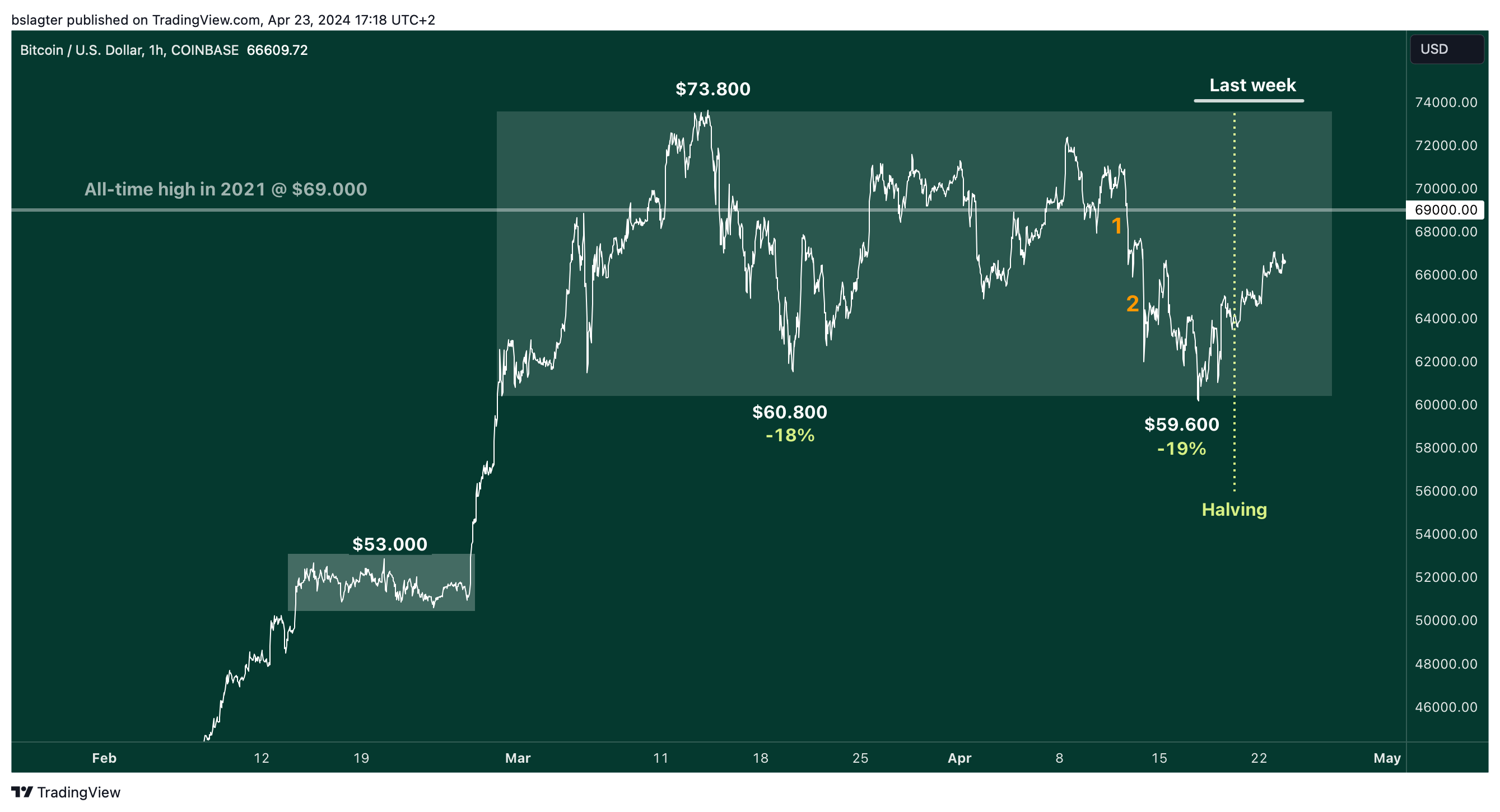

For the price of bitcoin, the halving has little significance in the short term. In the long term, however, the 450 BTC that no longer enters the market daily does have an impact. At the current price, $10 billion less capital inflow is needed annually to maintain the price. Currently, we see little of that. The cryptocurrency market has been in correction mode since March 14. After reaching the top at $73,800, the price dropped by 19% to the lowest point of $59,600. Currently, we are back in the middle of the price range, around $66,000.

For bitcoin, it has been a mild correction so far, but for most altcoins, it looks a lot worse. If measured from the highest point of this market cycle, we see quite a few major coins with losses of 40% to 60%. For some of these coins, this decline follows a huge price increase in the six months prior, such as Solana, Bittensor, and Celestia. Other coins have not risen much above the low point of the bear market.

The large differences between the different coins indicate that an alt season has not yet occurred, a period in which a large part of the altcoins rise in price faster than bitcoin. That's not surprising; even in previous bull markets, we only saw an alt season after bitcoin had risen well above the previous all-time high. For now, the focus remains on bitcoin.

News overview

Now that the halving is in the rearview mirror, the question arises: what lies ahead for bitcoin? Immediately after such a major event, which has been anticipated for months, there is a void that needs to be filled.

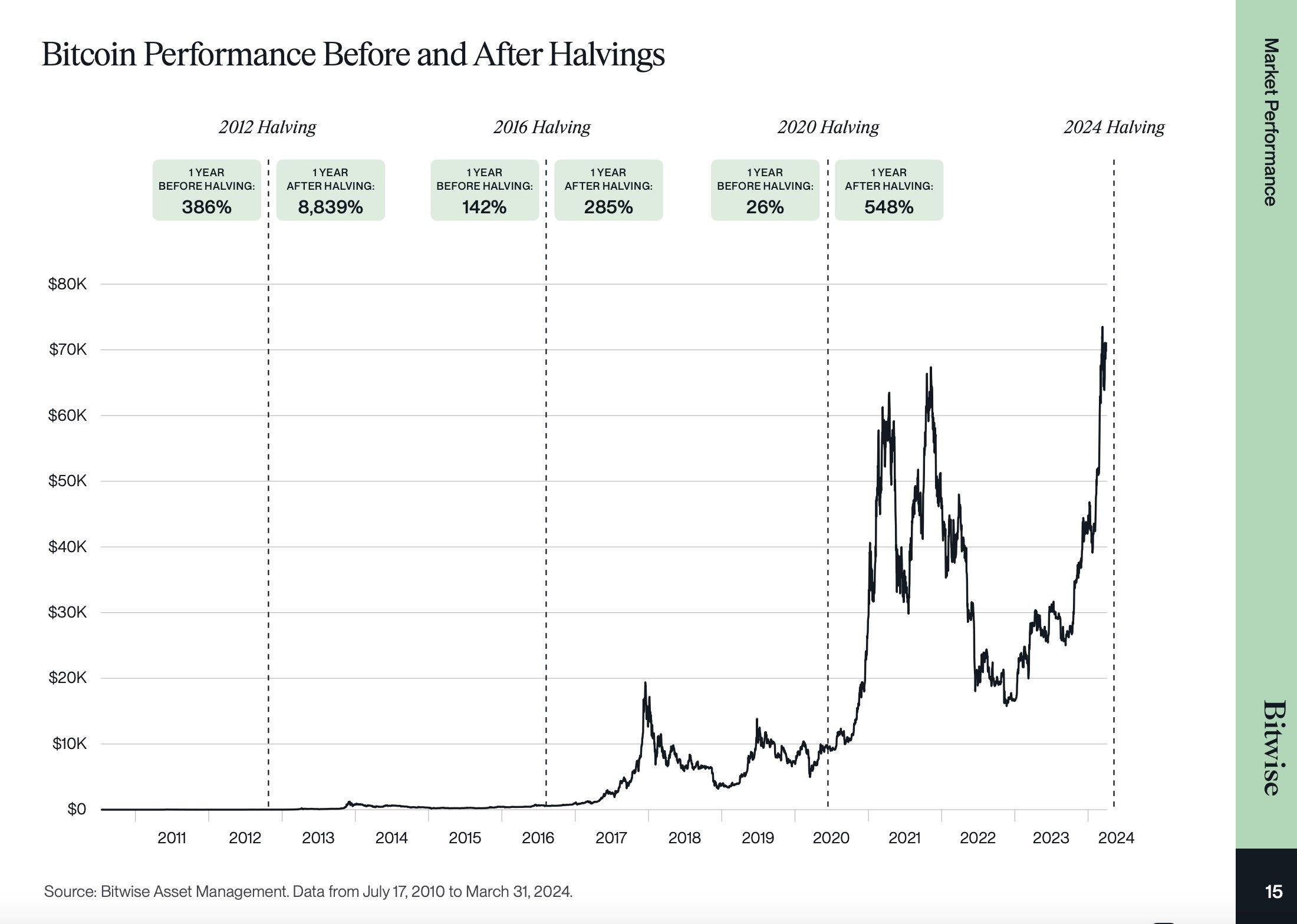

The tendency after the halving is that price expectations grab attention. This is due to the past. Over the past 12 years, bitcoin has performed exceptionally well. Looking at the bitcoin price a year after a halving, the following picture emerges:

- The halving of 2012: +8839%

- The halving of 2016: +285%

- The halving of 2020: +548%

The burning question: will this cycle rhyme with that of the past?

According to JAN3 CEO Samson Mow, the market is awaiting a positive supply shock. "The ETFs have slowly but surely taken bitcoins off the market, and now the production rate is also halved. Even before the halving, daily demand was five to ten times greater than supply."

In the interview, Mow revisits his predicted Omega Candles, large price jumps that ultimately reach around $1 million per bitcoin. It gives an idea of the broad range in which price predictions from prominent parties fall:

- CoinCodex: $179,000

- Michael Novogratz and Fred Thiel: $125,000 - $150,000

- Standard Chartered: $120,000

- Fundstrat: $180,000

- Jesse Myers: $100,000 - $130,000

- Anthony Scaramucci and Michael Saylor: >$100,000

- Cathie Wood: $600,000 (2030)

- FBS: $90,000

No one knows where the peak of the current cycle will be, but expectations are high. This is important for bitcoin miners because they need the price increase to become profitable again after the halving. In the past, their revenue decreased by an average of 45 percent in the first month after the halving. The price increase of bitcoin made up for this more and more afterward: a year after the halving of 2020, revenue had increased by 272%.

Crypto savings plan

Avoid buying at a single point at a high price and spread your purchases over a longer period. This investment strategy is known as Dollar Cost Averaging (DCA). By doing so, you spread the risk and give yourself peace of mind.

Do you want to purchase crypto assets periodically and automatically? With the crypto savings plan, that's easily arranged. All you need to do is ensure that there is sufficient balance in your account.

Other news:

- Are large investors supporting the bitcoin price? Hodlers with at least 0.1% of the total bitcoin supply added 19,760 BTC to their portfolios

during last week's price drop. According to analytics company IntoTheBlock, this is a hopeful sign: "Historically, these types of purchases have often been followed by increases in the bitcoin price."

- Ernst & Young (EY) will use Polygon to record business contracts. EY's OpsChain Contract Manager

(OCM) is designed to record complex contracts involving multiple parties. It uses zero-knowledge proofs (ZKPs) to ensure the privacy of the parties involved.

- Inflow into U.S. bitcoin funds rebounds after a red week. In total, investors withdrew $319.3 million from the funds last week. Friday ended this red streak with an inflow of $59.6 million. BlackRock's fund (IBIT) has not seen outflows since its launch, an impressive streak of 69 days.

Behind the scenes

Bitcoin Halving Party

The bitcoin halving was extra special thanks to the Halving Party at the Posthoornkerk in Amsterdam last Friday. As a sponsor, we saw hundreds of bitcoiners come together to toast the coming four years. Herbert Blankesteijn, host of the BNR Cryptocast, gave a stern sermon, and our developer Dayan came in second place in the bitcoin quiz created by Bart Mol and Daniël Mol. A great start to the next four years!

Behind the scenes

Update login page

Our product and IT team are continuously working on improving the Amdax app and web environment. This week, the native login function in our web environment was successfully implemented. With this update, as a user, you will not be redirected to an external login page but will stay in the Amdax web environment. Besides looking visually cleaner, it also provides a better user experience!

Always stay up to date?

Subscribe to the Amdax Weekly and receive a new Weekly in your mailbox every Wednesday.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.