Bitcoin ETFs rise "frighteningly" fast

13 March 2024

Once again, we are witnessing an energizing crypto week. Bitcoiners are hoping $70,000 will be far in the rearview mirror, and U.S. bitcoin funds seem to be helping with that. In Ethereum circles, a major upgrade is in the pipeline. More on that in this Weekly!

This Weekly in brief:

- Market: Bitcoin surged above $73,000, once again setting a new record. Ether broke through the $4,000 barrier and is heading towards its all-time high of $4,800.

- News: Ethereum upgrade Dencun is successful. Second-layer networks (L2s) can now efficiently and affordably record their data on Ethereum. This makes the Ethereum ecosystem more usable for a wider group of people.

- Behind the scenes: We spoke to Tommie van der Bosch (Web3 Director at Deloitte) about the collaboration between Deloitte and Amdax and look back at our trip to Bitcoin Atlantis in Madeira.

Market update

"An earlier all-time high rarely gives in easily," we noted in the previous Amdax Weekly. Gold is a good example of this. The price of the precious metal rose to nearly $2,200 last week, finally surpassing the previous all-time high of $2,070. A process that took three years.

With bitcoin, we also witnessed a strong reaction last week when it encountered the magical threshold of $69,000 for the first time. How long would the battle with the 2021 record last? The answer came after just a few days. Last Monday, the price convincingly surged well above $70,000. The highest point is now above $73,000. Impressive!

The chart below shows the price of bitcoin over the past four years. The bear market of 2022, with the implosions of Luna, Celsius, and FTX, is visible. But the new bull market is also starting to take shape.

We have marked the price range in which the price was in December and January with the letter (A). The opening of this year, at $42,500, lies precisely in the middle. There was an upward spike with the launch of the ETFs and a downward spike with the subsequent correction. After hitting bottom on January 23, the price has already risen by 90%.We marked the brief pause at the all-time high of $69,000 with (B). We are now unmistakably above that with $73,500 (C). And by many measures, we are still only at the beginning of this bull market.

The bitcoin dominance has been hovering sideways around 53% since October, sometimes dipping slightly below and sometimes inching above. This means that, roughly speaking, the rest of the crypto market is performing just as well as bitcoin when combined.

However, there are significant differences. While some coins have shown a spectacular rise, others have hardly increased in value when measured in dollars and have even declined relative to bitcoin. Many prominent members of the top 100 are still far below the peak of the previous bull market.

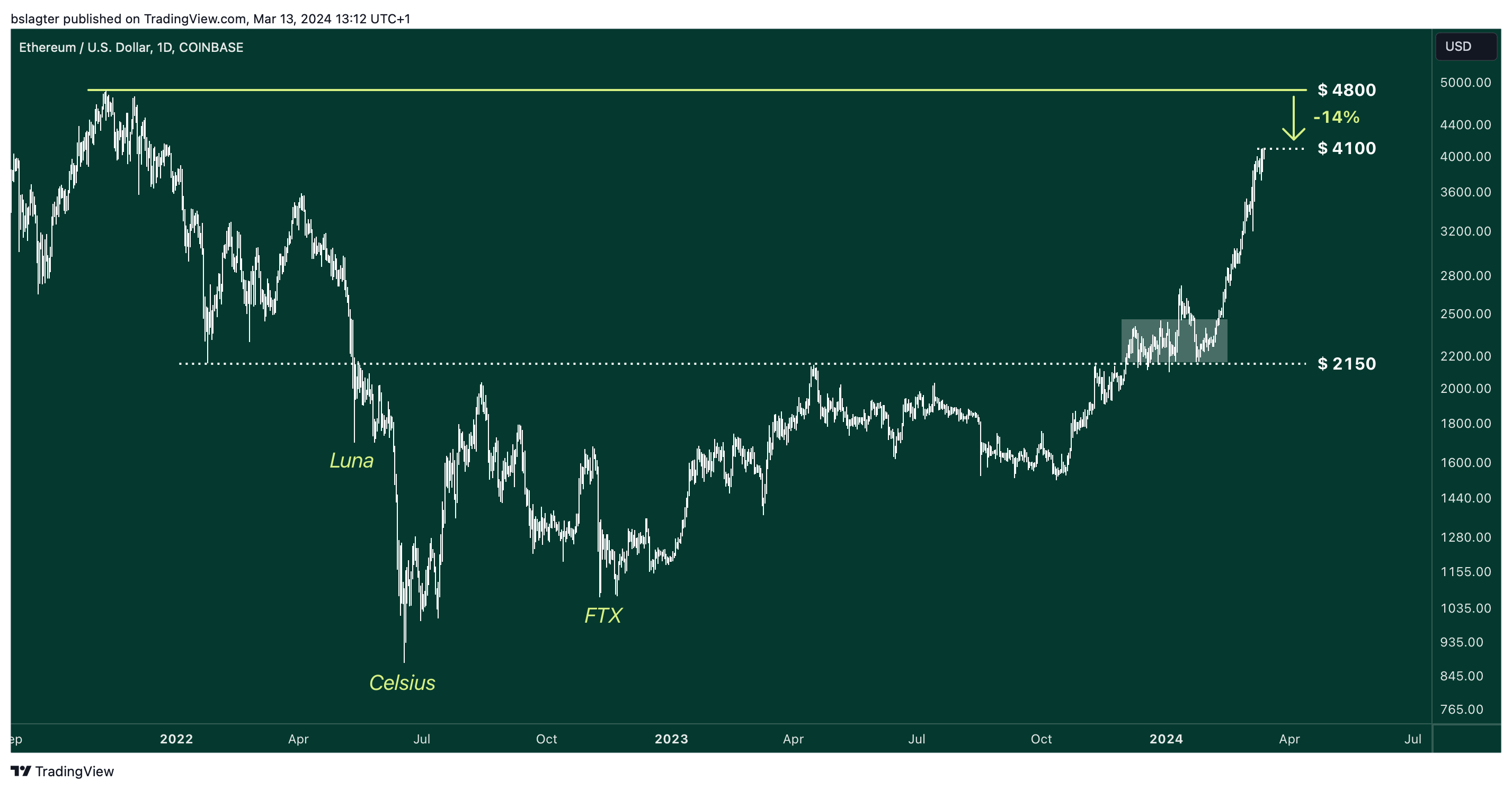

This is not the case for ether. The cryptocurrency of the Ethereum network has remarkably weathered the bear market. The dividing line between bear and bull markets lies at $2,150. Ether broke through that barrier last year, but parting ways with that price level proved challenging. Only in recent weeks has the coin surged upwards, reaching over $4,000. It is now only 14% below the all-time high of $4,800!

News overview

Today, Wednesday, March 13, marked the Ethereum upgrade Dencun on the agenda. It is the first step towards what is known as a rollup-centric network. With this upgrade, second-layer networks (L2s) can efficiently and inexpensively record their data on Ethereum.

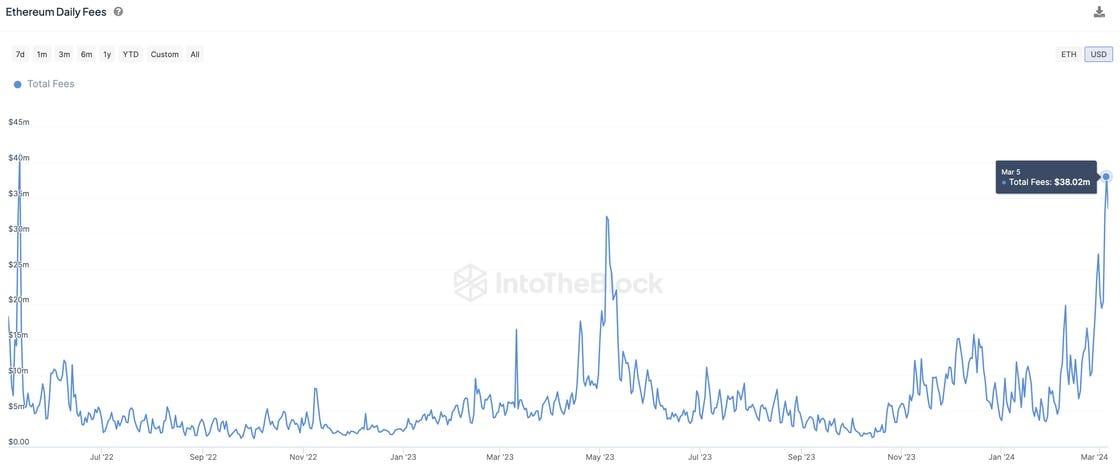

This is not a luxury, as transaction costs on Ethereum have risen sharply again. Last week, users paid over $200 million to have transactions processed. Because a portion of the ether used for this purpose is burned, the ether supply decreased by over 33,000 ETH. On average, a transaction costs $28; for many.

Analysts anticipate that with the arrival of Dencun, the use of L2s could become up to 90% cheaper. Depositing USDC on Aave would then cost only $0,0091, which is 27 times lower than it is currently. Speculators suspect that the cost reduction could increase to 60 times

the current level.

Asset manager Bitwise believes that as a result, the price of ETH will eventually rise. Why? Because the Ethereum ecosystem will become usable again for a larger group. The asset manager speculates that some of the audience that migrated to other platforms will find its way back.

The potential arrival of a spot ether ETF will assist in this, according to Bitwise. However, predictions regarding this matter have become somewhat more cautious. There is some nervousness because the regulator has not yet engaged with the applicants. Although they are willing, the SEC seems reluctant to take action at this time.

Amdax's asset managers stand alongside their counterparts at Bitwise. We foresee 2024 as the year of Ethereum. We elaborate on this extensively in our Amdax House View 2024, and in the latest episode of the podcast "Een Nieuwe Koers," we explain our perspective. If the ETF is not approved in May, they believe it will be eventually, as BlackRock will not jeopardize its untarnished reputation easily.

Crypto savings plan

Avoid buying at a single point at a high price and spread your purchases over a longer period. This investment strategy is known as Dollar Cost Averaging (DCA). By doing so, you spread the risk and give yourself peace of mind.

Do you want to purchase crypto assets periodically and automatically? With the crypto savings plan, that's easily arranged. All you need to do is ensure that there is sufficient balance in your account.

Other news:

- Cypherpunk Manifesto celebrates its 31st anniversary. On March 9, 1993, Eric Hughes published an important letter, A Cypherpunk’s Manifesto. In it, he describes the importance of privacy in an open society. The Cypherpunks have played a significant role in the history of Bitcoin and the emergence of cryptocurrencies.

- Trading volume on exchanges surpasses $100 billion for the first time in two years. This is according to data from The Block. Analysts see this as cautious evidence of the return of consumers. They also point to the rise of cryptocurrency apps in the Apple and Google App Stores in the United States.

- London Stock Exchange to open a desk for bitcoin and ether product applications soon. These are financial products that, like American exchange-traded funds, track the price of their underlying crypto assets. In total, over $3 trillion is invested through the London Stock Exchange.

Deepen

Tokenizing Real World Assets | Robert Leshner | Bankless

Over the past year, a shift has occurred among financial institutions and major market players. They no longer see crypto as exciting and dangerous, but as valuable public infrastructure on which digital assets can be recorded and moved. For this reason, Real-World Assets have become an important theme; transforming traditional, illiquid assets into tokens that are globally accessible and tradable. In the Bankless podcast, Robert Leshner was a guest. His mission? To get this trillion-dollar industry on-chain.

Behind the scenes

Deloitte: 'Digital assets are here to stay'

Driven by the maturation and increasing professionalization of the crypto sector, the traditional financial sector and the crypto industry are becoming increasingly intertwined. It is no coincidence that two leading companies - Amdax and Deloitte - are increasingly joining forces. Tommy van der Bosch, Web3 Director at Deloitte, shares his insights on the sector and the collaboration between Deloitte and Amdax.

Behind the scenes

Bitcoin Atlantis

Earlier this month, Amdax attended the Bitcoin Atlantis conference in Madeira to engage with pioneers from the sector and gain new insights. We look back on several successful days with interesting presentations and experiences.

Always stay up to date?

Subscribe to the Amdax Weekly and receive a new Weekly in your mailbox every Wednesday.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.