Base in the grip of Friend.Tech

30 August 2023

On Tuesday, Base, Coinbase's blockchain network, processed 16 transactions per second. The lion's share of that was attributed to Friend.Tech, a new app that is racing through the crypto world. What it is. And what it means for Ethereum? You can read that, and more, in this Weekly!

Cryptomarket

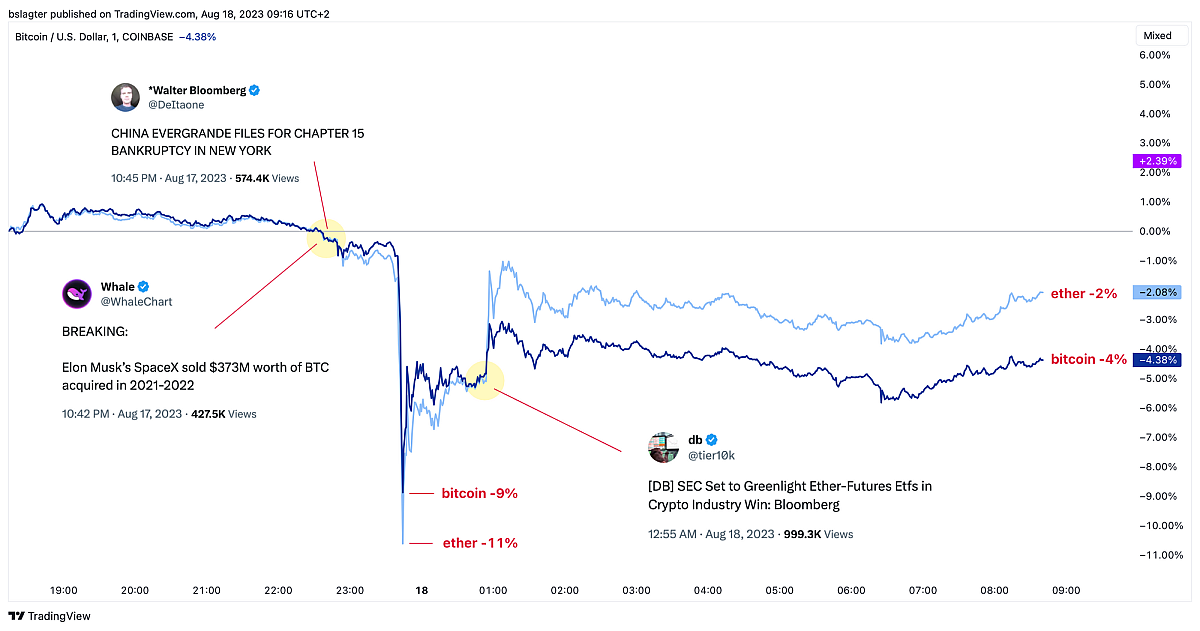

Last Thursday, a weeks-long period of calm in the crypto market came to an end. The price of bitcoin fell more than $2,000 from $27,500 to $25,200 in a matter of minutes. Soon we saw recovery to rates around $26,000, some 5 per cent below the starting point. In such a situation, the question of what caused this is immediately raised. What caused this mini-crash? The chart below shows the price movement of bitcoin and ether during the night from Thursday to Friday. We have included three tweets that tell the story.

At 22:42, a message appeared on Twitter that SpaceX had sold $373 million worth of bitcoin. This was echoed by many others in the hours that followed. The source appeared to be a Wall Street Journal article scrutinising the financial reports of Elon Musk's space company.

At 22:45, Bloomberg brought the news that Evergrande has filed for a moratorium in the United States. The Chinese real estate giant has been in dire straits for two years and announced last month that its losses in 2021 and 2022 had reached 73 billion euros.

At 23:41, the party really started. After an hour of slightly increased volatility, the price plunged from $27,500 to $25,200 in four minutes. Volume and volatility were back, but not in the way most crypto investors had hoped. During this short but violent price movement, many speculators who were trading with leverage went wet, they were forced to close their positions. This added fuel to the fire of an already falling share price. In total, more than a billion euros worth of liquidations have been registered.

At 0:55 am, Bloomberg reported that stock market regulator SEC plans to approve the ether futures-based ETF. Bloomberg's ETF watchers had previously expressed positive expectations about this. But now there are also reportedly whispers from the SEC that they do not intend to block the application.

In short, rumours about SpaceX and Evergrande created turmoil and uncertainty, and gave the first push down. A cascade of liquidations reinforced the move. And after positive news about the ether ETF, ether recovered a bit better than bitcoin.

By now we are a few days on, and we can look at this share price drop from a little more distance. The price has stabilised around $26,000, which is more than 10% lower than the $29,000 of the past two months. After a period of very low volatility, such a drop is a bit of a shock. But there is no question of panic; most crypto investors are used to worse!

In the chart below, you can see that the price has fallen down through a rising trend line and the 200-day average. A logical question is whether this now signals the end of the 2023 rising trend.

It is possible. But it is still (much) too early to judge that. We judge a trend over a period of months by data covering weeks or even months. We don't have those yet.

In doing so, we pay close attention to the horizontal price level of around $25,000. That has played an important role at several points over the past year and a half. The bulls would rather not see the price fall well below this dividing line and a weekly close confirm that decline.

Instead, a rapid rise after hitting this price level again would strengthen the bulls. Recapturing first $29,000 and then a price above $31,500 would be the icing on the cake in this regard!

News

In February this year, Coinbase grabbed the limelight with the launch of Base. This platform is intended to provide a bridge to the crypto economy for billions of people. Base is a so-called rollup, a second blockchain layer that takes over the execution of one or more transactions from the base layer. The latter is thus relieved of the burden and retains capacity for other work. The rollup turns it back into one by anchoring the result of its work summarised on the base layer.

Last week, the number of Base users took a big leap. The resulting increased activity reached a high of 16 transactions per second yesterday. "A lot because of Friend.Tech, but still - incredible growth," Coinbase ceo Brian Armstrong wrote on Twitter.

.@BuildOnBase hit 16 transactions per second yesterday

— Brian Armstrong (@brian_armstrong) August 22, 2023

lots due to @friendtech but still - incredible growth https://t.co/saHlb5cP7q

News summary

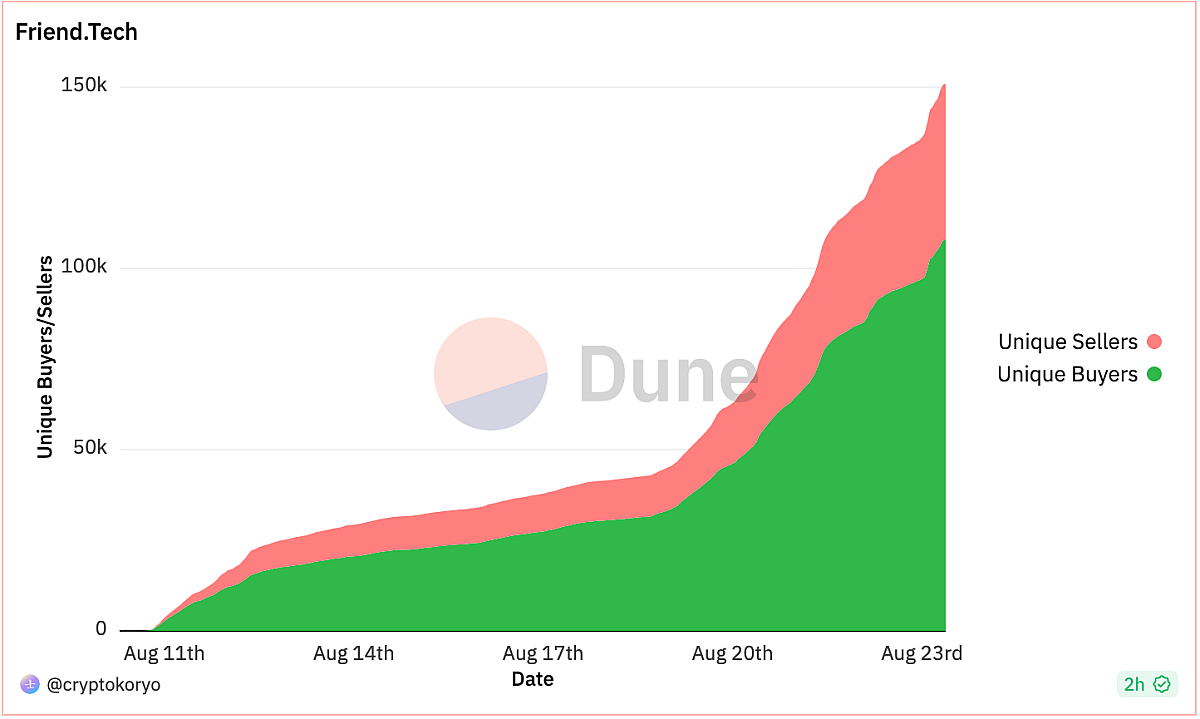

Friend.Tech heeft in korte tijd de aandacht gegrepen van cryptospeculanten. Deze app maakt het voor mensen mogelijk om te investeren in het sociale media-account van een ander. De investering levert een token op, en dat token geeft toegang tot een besloten omgeving voor direct contact tussen degene die het sociale media-account bestiert en de investeerders. Op dit moment doen vooral influencers eraan mee, die hun volgers hebben aangezet tot het kopen van een ‘aandeel’. Dat verklaart deels de sterk toegenomen activiteit.

The price of a stock rises as the demand for it increases. Thus, such a share has not only practical applications but also speculative characteristics. It is unclear which driver is currently strongest for Friend.Tech's growth, but given the current user base, speculation seems to prevail.

Because hype and hysteria are contagious, especially when euros and dollars seem to be flying around, we also point out the following:

- Friend.Tech presents itself as an app, but it is neither installed from official App Stores nor monitored.

- Little is known about where user data is stored and there are concerns about privacy safeguards.

- Share value is highly volatile and largely dependent on the creator and its behaviour. Does who decides to stop using Friend.Tech? Then chances are the price will fall quickly.

- Friend.Tech charges high fees for buying and selling tokens.

The platform's builders envision a great future in which creators and followers interact in many different ways. To make that happen, they have raised funding from Paradigm. Whether this will allow it to avoid the fate of previously fallen competitors? That remains to be seen, but its explosive growth to over 150,000 unique users is a notable difference.

Either way, this activity is supportive for Coinbase as it develops Base. But it could also be a glimpse of a bright future for Ethereum in which not just one rollup but thousands record their activities on it. That would make the crypto world's current number two token an indispensable technological building block in the decentralised infrastructure now under construction.

Other news:

SEC allowed by judge to appeal Ripple ruling. Normally, such an appeal process may be started only after the trial. Because of its importance, the SEC is allowed to file an appeal anyway. Ripple has until 1 September to respond, and the SEC then has another week to file a rebuttal to it. If the appeal is granted, the ongoing litigation will be paused until the appeal process is completed.

Bitcoin fan Javier Milei wins Argentine primaries. The right-wing populist surprised friend and foe by emerging victorious from the presidential primaries with 30 per cent of the vote. Milei has repeatedly spoken out against the function of central banks and regularly praises the benefits of bitcoin and other crypto assets. However, he has also been accused of promoting the Argentine ponzi Coinx. This led to legal charges against him.

FTX and Genesis reached a settlement for $175 million. Initially, FTX wanted to recover just under $4 billion from the bankrupt crypto lending company. FTX ceo John Ray is satisfied with the settlement. For Sam Bankman-Fried, FTX's former ceo, the world looks less rosy. In his lawsuit, he is likely to face evidence from the diary of Caroline Ellison, Alameda's former ceo. What is striking here is that Bankman-Fried himself leaked this diary to the press, in an attempt to blacken Ellison.

Deepen

You've probably read or heard something about people or companies being called on the carpet by their banks to explain what they are doing with their money. Are they not cooperating? Then they lose access to their bank account, whether the transactions are legitimate or not. Paul Buitink talks about this overbearing financial control state with Simon Lelieveldt in the podcast Holland Gold. A conversation about one of the most important topics of our time!

Behind the scenes

Do you want to buy your first home, save for a trip around the world or look after your child's future? We understand your dreams and financial goals. We also know that building wealth for later is challenging.

Investing in crypto is an interesting and potentially profitable way to reach your financial goals. The younger you are, the more time you have to grow your investment.

At Amdax, we make crypto investing accessible and personal. With a wide range of services to choose from, you can start building wealth for later, starting from €2500.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.