Altcoins Suffer Most in a Weak Crypto Market

21 August 2024

On August 5, the crypto market unexpectedly experienced a sharp decline. That turmoil is now two weeks in the rearview mirror, and bitcoin's price has been moving sideways around $59,000. Altcoins have been hit hardest by this status quo. What's our outlook on this? Find out more in this Weekly!

This weekly in brief:

- Market: The price of bitcoin is $59,000, and ether is $2,600. This is not much different from last week. The remarkable recovery after the turbulence on August 5 has not continued. Altcoins are suffering more than bitcoin as a result.

- News: In a sideways market, investors often become gloomy. But they also look for hopeful signs. This week, they find them in AAVE, a DeFi protocol performing well against the trend. Could this be a precursor to a broader DeFi renaissance?

Market Update

The turbulent price drops on Monday, August 5, caught many by surprise. Bitcoin's price fell 30% in a week from $70,000 to $49,000, the lowest point of this correction. This occurred even as the Republican Party in the US included a national bitcoin reserve in its election platform.

After the rapid price drop, an impressive recovery followed. By Thursday, August 8, the price was already back above $60,000. However, that recovery did not continue. We are now almost two weeks later, and the price has hovered around $59,000 the entire time.

Between $61,000 and $63,000, important dividing lines converge. The 50-day and 200-day moving averages are there. They guide short- and medium-term trends. Below them is bearish, above them is bullish. We are below, and there is still a lot of work to be done to break through.

In the chart below, we have divided the prices of the past 9 months into three zones. On the right is a volume profile, a histogram of the trading volume at a certain price. Above (1) and below (3) are two zones where a lot of trading has taken place. We can expect a lot of trading there again. Between $44,000 and $60,000, there is more air (2), and things can move quickly.

This is an argument to expect increased volatility in the coming weeks. This could be driven by macroeconomic data in the US or Japan and speeches by central bankers at the annual conference in Wyoming. It could also be exacerbated by the somewhat lower liquidity in the market during the summer period.

The turbulence of the past weeks has impacted most altcoins more negatively than bitcoin. The chart below shows bitcoin dominance, which is the share of the market occupied by bitcoin. We have filtered out the largest stablecoins. Over the past three years, dominance has increased from 40% to 60%. Altcoins have lost significantly relative to bitcoin.

Could the breakout above 60% be a sign of more weakness for altcoins? Or is the rise above 60% a temporary anomaly, and will dominance later this year fall out of this structure at the bottom? Only then would we talk about an 'alt season,' just like in 2021. Until then, bitcoin remains the frontrunner.

News Overview

The central theme in the market update is that altcoins are taking the brunt of the pain. The pattern of bitcoin gaining ground while altcoins lag behind is something we’ve seen before. It’s a kind of natural selection in the crypto jungle, where only the strongest survive.

Among the blood in the streets, one project stands out: AAVE. For those unfamiliar with this player, let’s take a step back. AAVE is a DeFi protocol that allows users to lend and borrow without the involvement of a central party. It is one of the leaders in the DeFi world and has performed remarkably well in recent weeks. While many altcoins were in a downward spiral, AAVE seemed to take off.

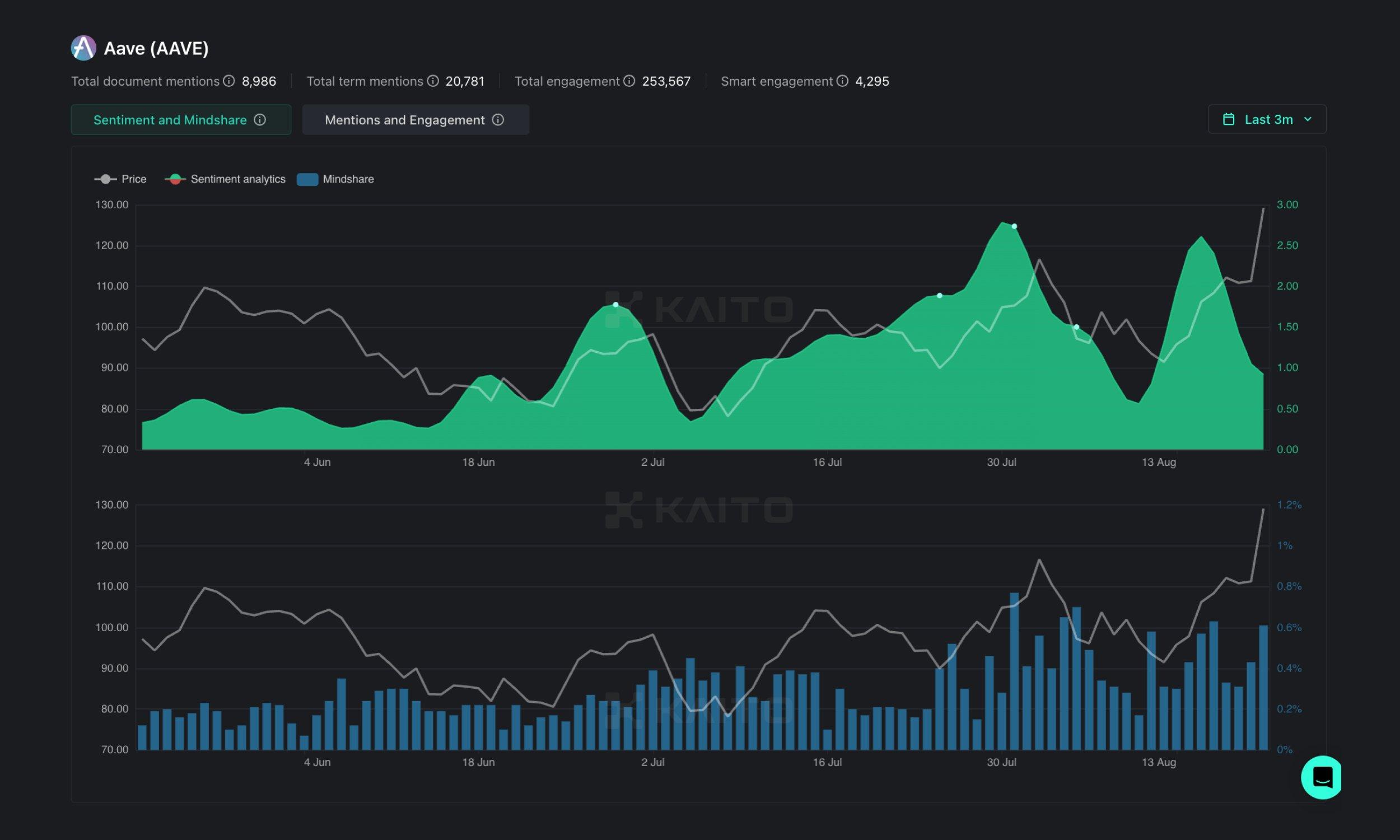

What are the reasons for this surge? According to the analytics firm Kaito, there are many. They point to new proposals within the AAVE ecosystem that offer extra rewards to token holders. These innovations are attracting the attention of investors and users, who in turn are posting impressive usage figures. AAVE has reached an all-time high in both the number of lenders and the total deposits, and during market declines, the protocol has raked in significant liquidation fees. Add to that the fact that AAVE is positioning itself as a market leader on multiple networks, and you can see why there is optimism about this coin.

It’s tempting to think that AAVE is the harbinger of a broader DeFi renaissance. DeFi has recently been sidelined by other hypes such as AI tokens and memecoins. But now there seems to be renewed interest. The recent rise in "mindshare" – the extent to which DeFi is discussed and considered – suggests a resurgence, according to Kaito. And yes, if DeFi does indeed make a comeback, it could trigger an upward movement in the broader altcoin market.

However, we should be cautious about too much enthusiasm. As always, there are many caveats to these assumptions. The market is still very volatile, and although the off-chain signals seem positive, the real on-chain evidence has yet to follow. It’s a bit like thinking it’s summer on the first day of spring. It could happen, but it’s more likely that there are still a few cold nights ahead.

We’ll keep an eye on it but with a good pair of sunglasses on. The first spring sun can sometimes be deceptively bright!

💡 Crypto savings plan

Spread your purchases over a longer period and invest in crypto without actively engaging yourself in it. This investment strategy is known as Dollar Cost Averaging (DCA). With it, you invest at an average purchase price, reduce risk, and gradually build up your position.

Want to buy crypto assets periodically and automatically? With the crypto savings plan, it's easy to do. All you have to do is make sure there is sufficient balance in your account.

Other news:

- Is the hype around AI tokens finally over? In the first half of 2024, this investment category benefited from the strong momentum surrounding artificial intelligence. Nvidia was the clear frontrunner, and with a market value of $3335 billion, it became the most valuable company in the world. After a brief period of setbacks, Nvidia’s stock value is rising again. The outlook for AI tokens is less rosy. The price decline continues, with many losing between 30% and 40% in value over the past 30 days.

- Revenue of pump.fun surpasses that of Ethereum and Solana. On August 14, the memecoin platform alone generated more revenue than the 14 other protocols that made up the top 15 combined. In total, the platform has earned its creators more than $100 million since its launch. You can bet that in the coming weeks and months, competitors will undoubtedly emerge.

- South Korea's national pension fund invests in bitcoin. In the second quarter of this year, it purchased nearly $34 million worth of MicroStrategy (MSTR) shares, which are seen as a proxy for bitcoin exposure. The National Pension Service of South Korea is one of the largest pension funds in the world. It was established in 1988 and manages the pensions of millions of South Koreans.

Our website uses cookies

We use cookies to personalize content and advertisements, to offer social media features and to analyze our website’s traffic. We’ll also share information about your usage with our partners for social media, advertising and analysis. These partners can combine this data with data you’ve already provided to them, or that they’ve collected based on your use of their services.